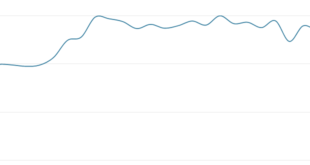

The oilfield service addressable market is defined by E&P capex budgets. Get data-driven insights on what that means for the rest of 2021 here… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »Out Think

Public Shale E&P Underspend In 1Q Creates Running Room Into Early Summer, But Capital Discipline Reigns Supreme

What’s going on with the oilfield service addressable market defined by E&P capex budgets? Data-driven insights here… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More »SimulFracs Will NOT Be A Rebundling Catalyst For Direct Sourcing E&Ps [Simulfrac Series]

Today we continue our simulfrac series with a fourth installment discussing implications for bundling vs. unbundling. Previously on the simulfrac series: “why it matters” and a thematic primer, before diving into E&P spending pattern implications. When it comes to direct sourcing… There’s a lot more to this story… Login to …

Read More »Putting E&P Spending Seasonality On Steroids? [Simulfrac Series]

The simulfrac trend is spreading fast in shale, and rightly so. Whatever frac efficiency metric you look at – whether it’s stages/crew day or stimulated feet per month or pumping hours per quarter or time on location – the step changes simulfracs are delivering are disruptive and mindblowing. The implications …

Read More »How, What, Where, Why, Why Now, & Who? [Simulfrac Series]

This week, we launched a new research series covering the implications of simulfrac adoption across the completions market. The series kicked off with thoughts on why it matters and future thought pieces will trace the trend’s ripples into specific niches of the US shale value chain (like sand and water …

Read More »Vanishing Idle Time In Fracs – Breaking Down The Next Big Step In Shale’s Efficiency Journey [Simulfrac Series]

The simulfrac trend is spreading fast in shale, and rightly so. Whatever frac efficiency metric you look at – whether it’s stages/crew day or stimulated feet per month or pumping hours per quarter or time on location – the step changes simulfracs are delivering are disruptive and mindblowing. The implications …

Read More »The ‘Real McCoy’ In Frac Sand Demand Models [Charts Of The Day]

Over the past week, we’ve been sharing a series of data-driven reports on Permian frac sand volume trends. First, this chart of the day showed Permian proppant consumption returning to peak. The peak Permian sand piece prompted good questions about how sand can return to prior highs in an environment …

Read More »Frac Sand’s Separation From Traditional Drivers Introduces Forecasting Risks [Charts Of The Day]

Last week we shared a chart of the day showing Permian sand volumes returning to within 10% of the all-time best quarter in 2021 and breaking the record in 2022. That research prompted some rational thinking and questions, both from our members in the comments section and the EFT crew …

Read More »Frac Customer Update Roundup – Fleets, Stages, OFS Pricing, Rigs, DUCs & More…

Here is the straight skinny on what’s going on with the D&C programs for 27 operators. One thing that stands out is the common focus on… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »How Will The Liberty Deal Reverberate In The Frac Sand Value Chain? [A Special 3-Part Report]

Now that we’ve all had a couple days to process the biggest frac industry news in quite a while, what does the M&A transaction mean for the proppant supply chain? Specifically frac sand and last mile logistics pure-play vendors? We have some strategic recommendations and actionalbe analysis on the competition …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve