Infill Thinking members are already up to speed on the first two frac sand mine facilities planned in the Permian Basin (Hi-Crush’s Kermit site and Black Mountain’s first Winkler County mine). Although other specific sites have yet to be announced, it’s no surprise they are in the works. Today, we identified two more …

Read More »Quick Thoughts

Here’s The First Look At The Permian Basin’s Original Frac Sand Mine [Progress Pic]

A quick update here (including our first visual) on the new Permian Basin frac sand mine that started it all. On Monday evening the new facility’s owner provided an update on the new mine’s construction progress. As part of that, the company shared the very first peek at what they’ve been building …

Read More »Weatherford Finally Focuses On Process Over Outcome

A portfolio manager I worked for in a prior life always said “focus on process not outcome.” It’s a helpful way of approaching problem solving and decision making by shutting out the distraction of daily progress toward goal. At the end of the day, outcome is all that really matters to stakeholders …

Read More »Thoughts On Emerge Energy Services’ Discussion Of The New San Antonio Mine

After announcing the acquisition of a San Antonio sand mine on Monday, Emerge Energy Services hosted a conference call on Wednesday to discuss the deal and future plans for the site. If you need to get up to speed on the transaction and our initial take, please refer to this …

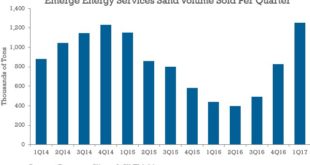

Read More »First Peek At 1Q17 Frac Sand Volumes Doesn’t Disappoint, But Is It Enough?

Alongside Emerge Energy Services’ Eagle Ford sand mine announcement on Monday, the company also gave us the first peek at actual 1Q17 sand demand. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »Check Out The Delaware Doozy That Is Turning Heads

The latest EOG Resources well in the Delaware basin is turning heads after a big IP24. It also has implications for frac sand consumption. We’ve got all the details for you in this update (take out our free 30-day trial below to read). There’s a lot more to this story… …

Read More »Nabors Industries Is Unstacking High Spec Land Rigs Faster Than Expected

Nabors released an operational update Monday morning, disclosing how the rapid US rig count growth trajectory during the first quarter is impacting their business. Like Halliburton, Nabors is incurring unexpected costs associated with the outsized growth relative to prior expectations. There’s a lot more to this story… Login to see …

Read More »Halliburton Will Mow Down The Competition In 2017, Whatever The Cost

Halliburton took an unusual step on Friday morning, hosting a conference call before the quarter ended to provide an operational update. On the call, Big Red put all other US pumpers on notice: the US is their turf and they won’t give it up easy. The company has executed a strategic pivot from …

Read More »Tor Olav Troim Moves On Transocean’s Jackup Fleet As Expected

As Upstreamonline first reported and we discussed last week, Norwegian startup Borr Drilling has been sniffing around Transocean’s jackup fleet. On Monday, Borr Drilling put out a press release confirming the reports. The company says it has signed an LOI with Transocean for the purchase of 15 jackups. Transocean has not released …

Read More »Halliburton Rumored To Be Buying Aker Solutions

This morning, the Norwegian Financial daily Finansavisen reported in no uncertain terms that Aker Group, owned by Kjell Inge Røkke, is about to sell Aker Solutions to Halliburton. We have detailed analysis of the possibility including a cliff hanger question you don’t want to miss… There’s a lot more to this story… Login …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve