Our regular weekly analysis of Baker Hughes rig count statistics is below, but first some campaign speech. This weekend, we are taking a break from the political rhetoric to look at drilling campaigns.

For the first time in two years, the US Independents are flexing up their drilling programs. Here are the most interesting campaign soundbites a half dozen US Independents dropped over the past two weeks:

Pioneer Natural Resources: “We are in the midst of increasing our horizontal rig count. We have a couple more rigs that need to come in November to complete the total addition of five rigs. That’ll put us with 17 rigs in the northern Spraberry/Wolfcamp area by year end… The fact that we’re improving our productivity in the Spraberry/Wolfcamp field area with the horizontal drilling campaign and completions optimization is allowing us to actually increase our forecast for this year’s production from 13%+ to 14%+.”

Pioneer Natural Resources: “We are in the midst of increasing our horizontal rig count. We have a couple more rigs that need to come in November to complete the total addition of five rigs. That’ll put us with 17 rigs in the northern Spraberry/Wolfcamp area by year end… The fact that we’re improving our productivity in the Spraberry/Wolfcamp field area with the horizontal drilling campaign and completions optimization is allowing us to actually increase our forecast for this year’s production from 13%+ to 14%+.”

EOG Resources: “More efficient rig operations are driving drilling days down to less than six days a well. Completions are also getting more efficient… and we are now completing wells 66% faster [than in 2014] at almost 1,000 feet per day… Right now we have 15 rigs operating domestic… Right now we’ve got five in Midland [Delaware Basin]. We have six now in San Antonio. We have four in the Rocky Mountains because we have one rig that was required on the Yates position in the Powder River Basin, and we’ll be letting it go. We’re going to be picking up an additional rig for the Delaware Basin at year end and also for the Eagle Ford… [Due to efficiency gains] we will not be required to ramp up the number of rigs very much for most any plan that we put in place.”

EOG Resources: “More efficient rig operations are driving drilling days down to less than six days a well. Completions are also getting more efficient… and we are now completing wells 66% faster [than in 2014] at almost 1,000 feet per day… Right now we have 15 rigs operating domestic… Right now we’ve got five in Midland [Delaware Basin]. We have six now in San Antonio. We have four in the Rocky Mountains because we have one rig that was required on the Yates position in the Powder River Basin, and we’ll be letting it go. We’re going to be picking up an additional rig for the Delaware Basin at year end and also for the Eagle Ford… [Due to efficiency gains] we will not be required to ramp up the number of rigs very much for most any plan that we put in place.”

Continental Resources: “We’re not looking at increasing rig activity. We’ve got a lot of uncompleted wells here… The incremental dollars that we have that we put into the Bakken clearly would go into the DUCs because it’s the most capital efficient thing we can do. And so, if you see us ramping anywhere, it’s going to be ramping up of stim crews.”

Continental Resources: “We’re not looking at increasing rig activity. We’ve got a lot of uncompleted wells here… The incremental dollars that we have that we put into the Bakken clearly would go into the DUCs because it’s the most capital efficient thing we can do. And so, if you see us ramping anywhere, it’s going to be ramping up of stim crews.”

Cimarex: “In the fall of 2014, we had 26 operated rigs running. We reached a low in summer of 2016 with four operated rigs… We had an average of five operated rigs running during the quarter. These rigs were busy working to hold acreage in both the Wolfcamp and Meramec plays. We have recently added three rigs, one in the Anadarko and two in the Delaware Basin, and we have plans to add another rig in Anadarko by year-end… While we work through our completion backlog, we will pick up the pace on our drilling activity as we head into 2017.”

Cimarex: “In the fall of 2014, we had 26 operated rigs running. We reached a low in summer of 2016 with four operated rigs… We had an average of five operated rigs running during the quarter. These rigs were busy working to hold acreage in both the Wolfcamp and Meramec plays. We have recently added three rigs, one in the Anadarko and two in the Delaware Basin, and we have plans to add another rig in Anadarko by year-end… While we work through our completion backlog, we will pick up the pace on our drilling activity as we head into 2017.”

Callon Petroleum: “We’re now positioned to accelerate the value proposition of our asset base across all three of our focus areas. We started this effort during the third quarter with a return of our second horizontal rig, which is now dedicated for our WildHorse area, while the other rig remains focused on the Monarch area. The team is now preparing for the addition of a third rig in January of 2017 and a fourth rig in the second half of 2017.”

Callon Petroleum: “We’re now positioned to accelerate the value proposition of our asset base across all three of our focus areas. We started this effort during the third quarter with a return of our second horizontal rig, which is now dedicated for our WildHorse area, while the other rig remains focused on the Monarch area. The team is now preparing for the addition of a third rig in January of 2017 and a fourth rig in the second half of 2017.”

Carrizo: “Given our deep inventory of drilling locations that generate excellent returns at strip prices, we are currently planning to add a third full-time rig in early 2017. With this level of activity, we would expect to generate 2017 crude oil production growth in the 20s on a percentage basis, depending on when we add the rig and how the activity is split between the Eagle Ford and Delaware Basin. At this point, we haven’t locked in any long-term service contracts so we retain the flexibility to remain at two rigs, if commodity prices pull back significantly.”

Carrizo: “Given our deep inventory of drilling locations that generate excellent returns at strip prices, we are currently planning to add a third full-time rig in early 2017. With this level of activity, we would expect to generate 2017 crude oil production growth in the 20s on a percentage basis, depending on when we add the rig and how the activity is split between the Eagle Ford and Delaware Basin. At this point, we haven’t locked in any long-term service contracts so we retain the flexibility to remain at two rigs, if commodity prices pull back significantly.”

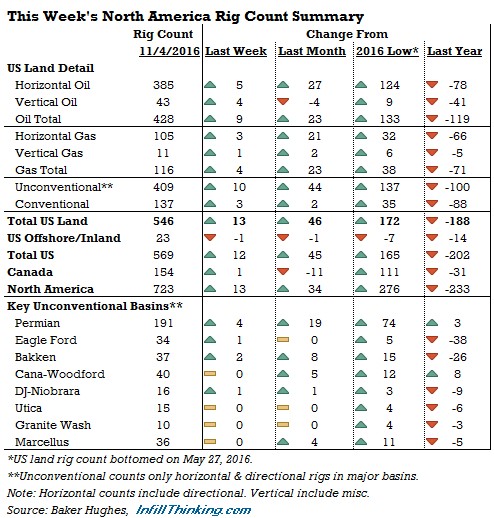

Weekly Drilling Update

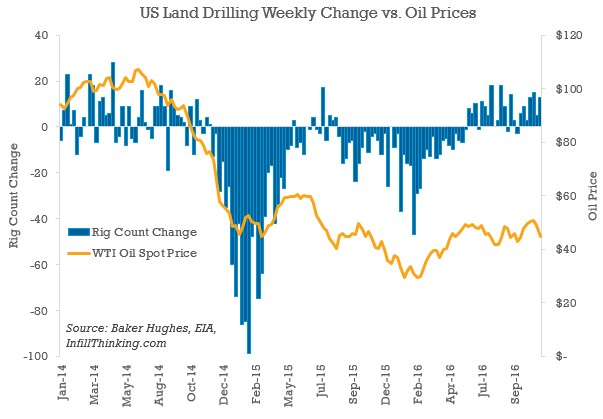

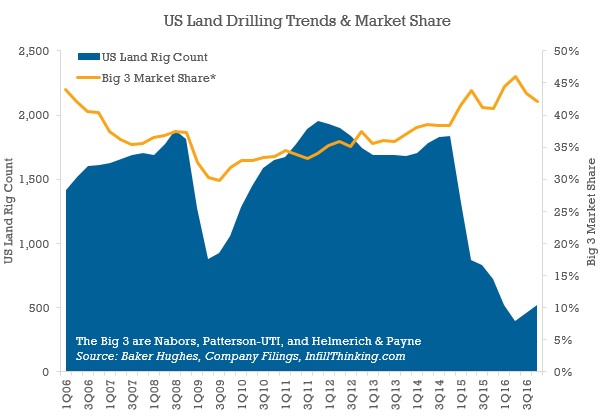

The US land rig count rose for a seventh consecutive week as 13 more derricks rigged up last week, bringing the active total to 546. The US land rig count is now up 172 rigs from the May bottom, with almost half of the gains coming from recovering Permian unconventional activity.

Drilling activity began to pick up in late-2Q16, about four months after oil prices bottomed. Even with crude oil prices still down by half from the peak, drilling activity is rising. This nascent drilling recovery at $45-$50 oil is made possible by a combination of efficiency gains, cost reductions, well completion optimization, and high grading. The ramp up is unlikely to accelerate (and may stall) if oil prices fail to continue their recent upward trajectory.

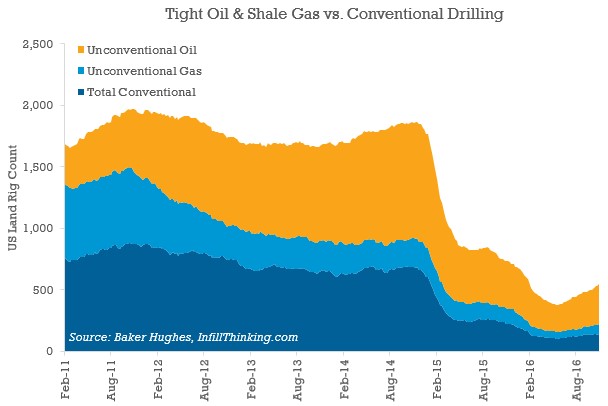

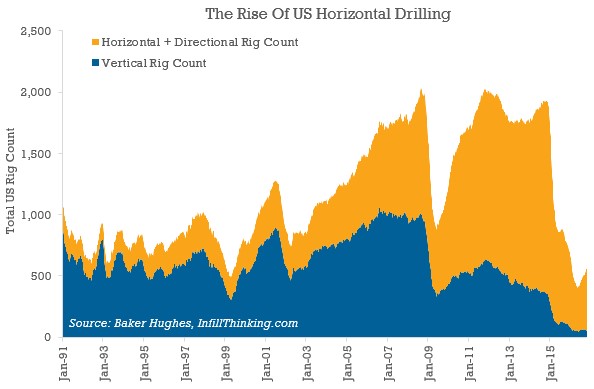

The recovery has been driven mostly by returning horizontal drilling in unconventional basins. Today, 75% of all drilling activity is unconventional up from 62% around the activity highs during 2014.

Similarly, horizontal activity has continued to take share in the US market. Today, only 10% of drilling rigs are punching straight holes. Go back to the prior trough in 2009, and 40% of the rigs working were drilling vertically. In the 2009 V-shaped recovery, vertical participation was higher.

The large US land drilling contractors have taken market share during the downturn thanks to their long-term contracts and baseline unconventional activity which requires highly capable rigs. This is a departure from the prior downturn, where the Big 3 lost market share in the collapse.

In the recovery phase there will be puts and takes for Big 3 market share. Smaller contractors are bidding aggressively on dayrates, hoping to take share. However, if vertical drilling (which is often carried out by mom and pop drillers) doesn’t stage a comeback, the largest contractors may continue to consolidate the market.

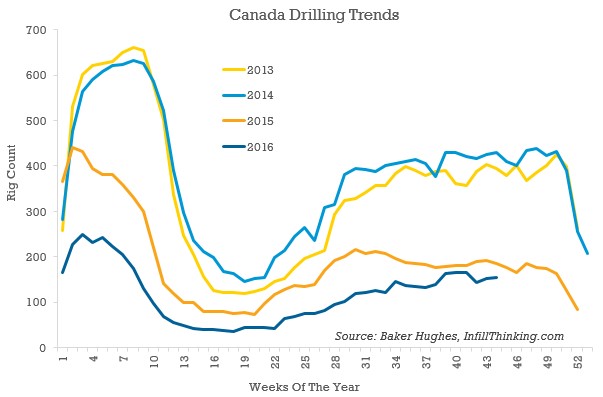

North of the border, drilling activity is flirting with year ago levels, flattening out after a multi-year decline. Summer and early fall drilling activity barely achieved the kind of activity levels of a typical spring breakup. Spending in 2017 is expected to be modestly higher than 2016, but Canada will require higher commodity prices than in the US to stage a fuller recovery.

There’s a lot more to this story…

Login to see the full update…

Members get:

- Exclusive research update newsletters

- High-caliber, data-driven analysis and boots-on-the-ground commentary

- New angles on stories you’ll only find here

- No advertisements, no noise, no clutter

- Quality coverage, not quantity that wastes your time

- Downloadable data for analysts

Contact us to learn about signing up! [email protected]

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve