Exxon held their annual analyst day in early-March and released a 75-slide IR deck for the event.

After wading through the first twenty slides on “new energy” (hydrogen, carbon capture, solar, wind, climate change etc.), we did find some slides that shed new light on the oil major’s plans for their marquis asset – the Permian Basin.

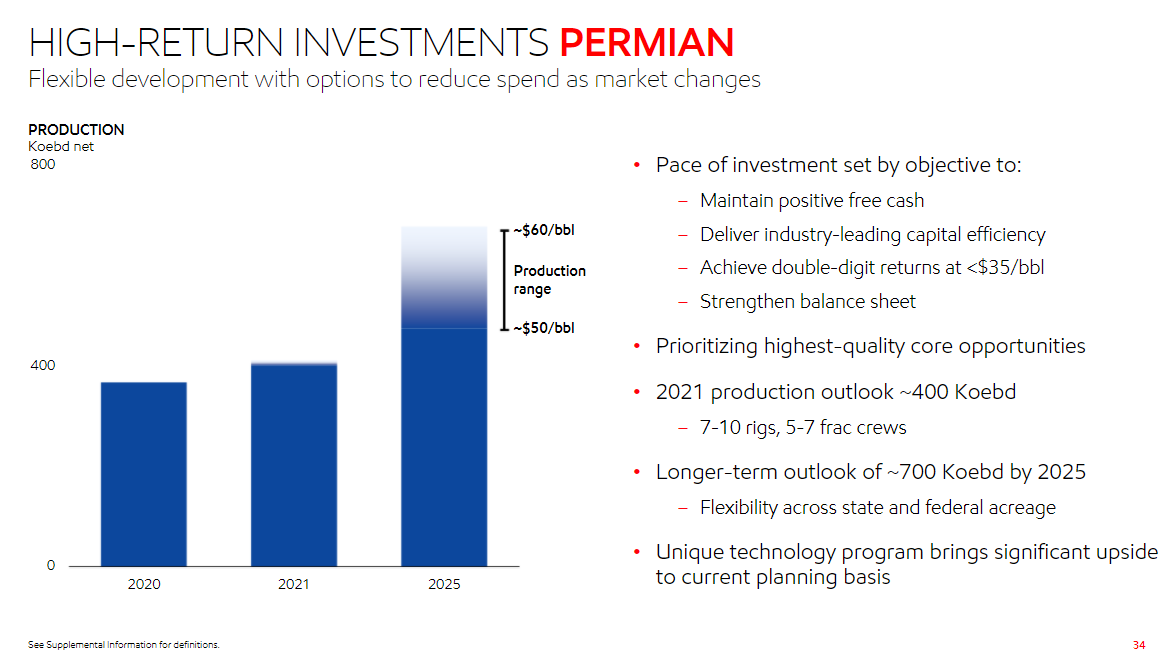

Recall that the operator recently slashed their long-term Permian production outlook without much fanfare (our coverage here).

Here are the relevant takeaways for the oilfield marketplace from Exxon’s new Permian disclosures.

-

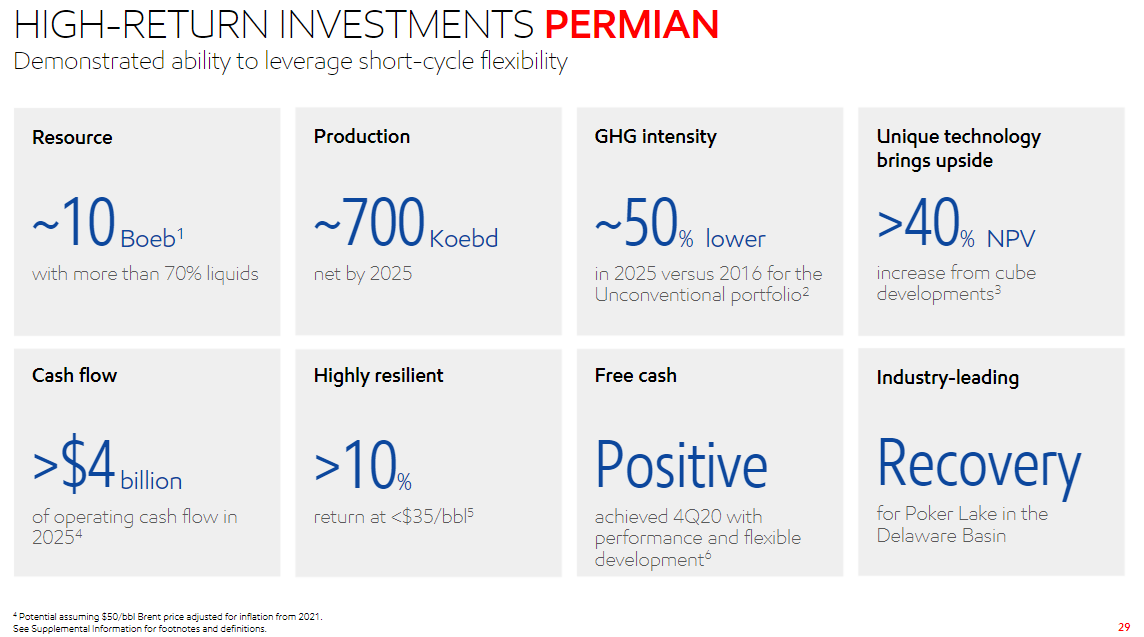

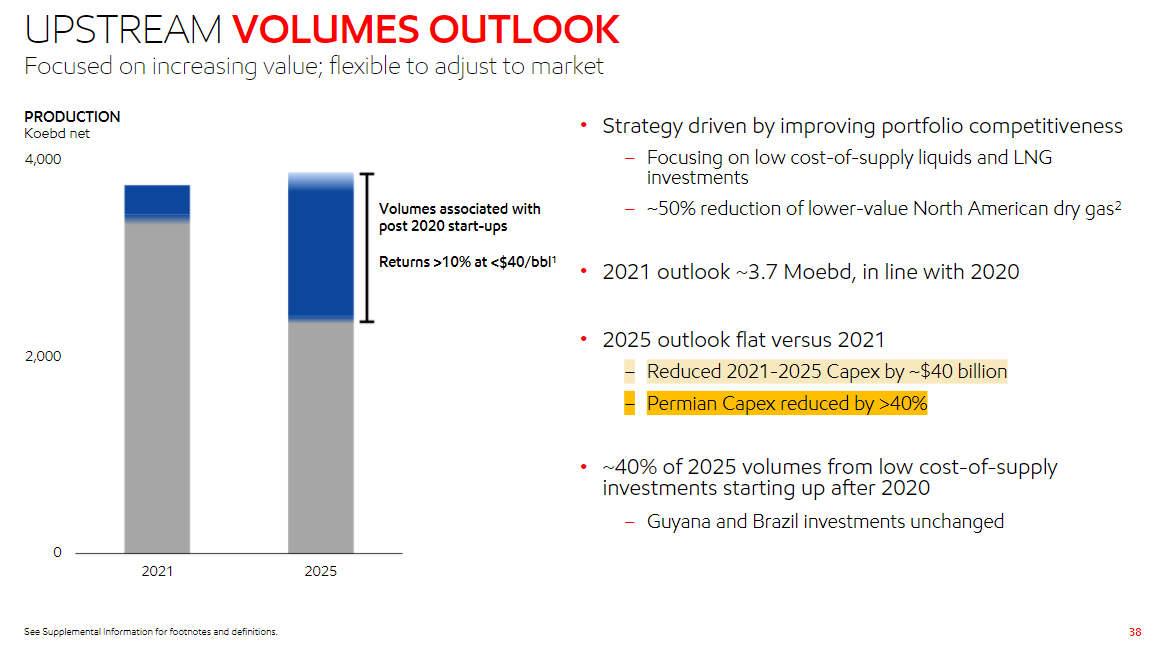

- Exxon has reduced their Permian upstream capex budget plan by >40% for the 2021-2025 period

- In 2021, Exxon plans to run 7-10 rigs and 5-7 frac crews in the Permian to produce about .4mmboepd

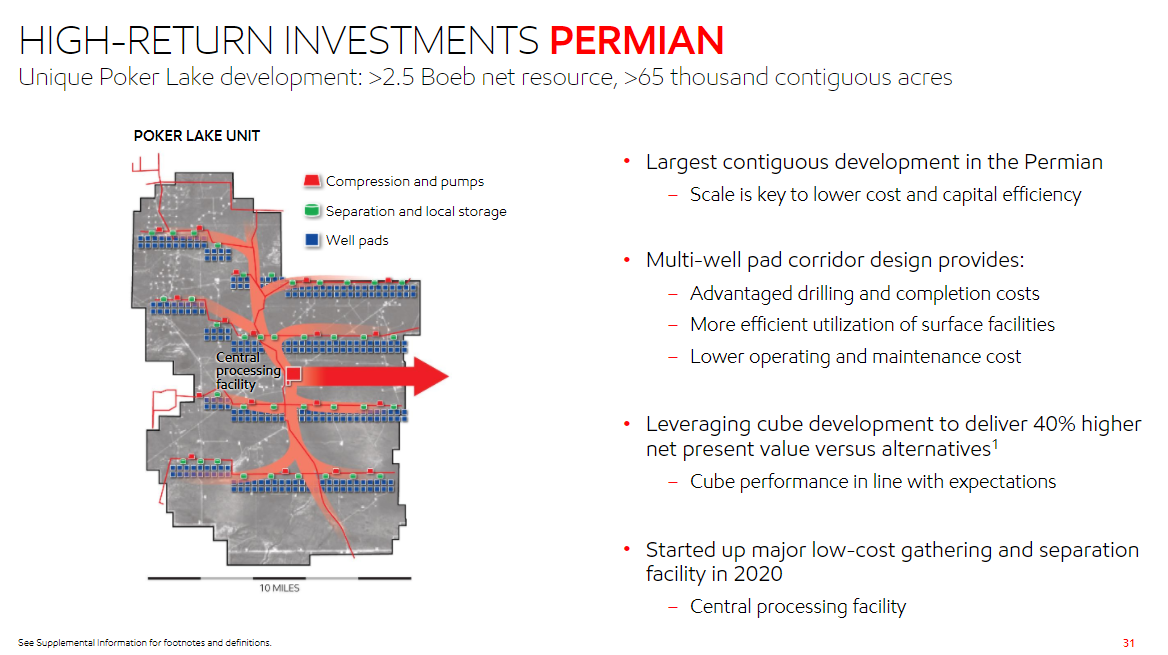

- Management notes flexibility across state and federal acreage (20% of their Permian position is on federal lands, including Poker Lake)

- Management says they make double digit returns on Permian wells at oil prices below $35 / bbl (our guess is that’s a better return than many of their vendors are making at $60 oil, since economic rent continues to accrue to operators at the expense of the oversupplied service sector)

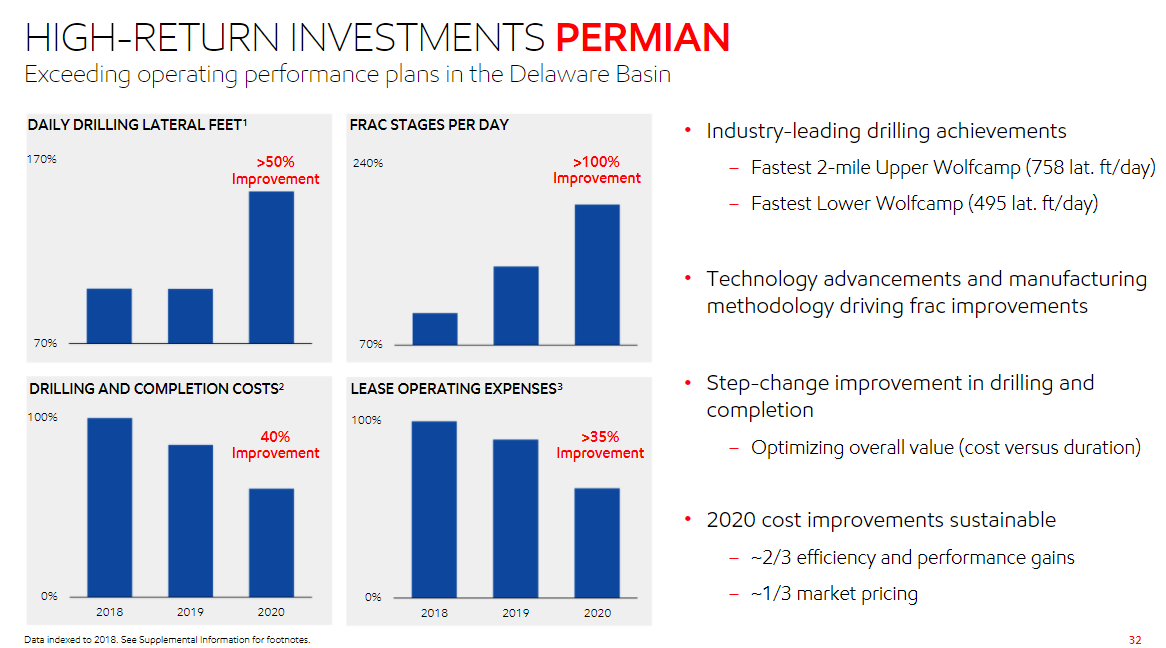

- Management said well cost savings in 2020 came 2/3rds from efficiency / performance gains and 1/3rd from market pricing

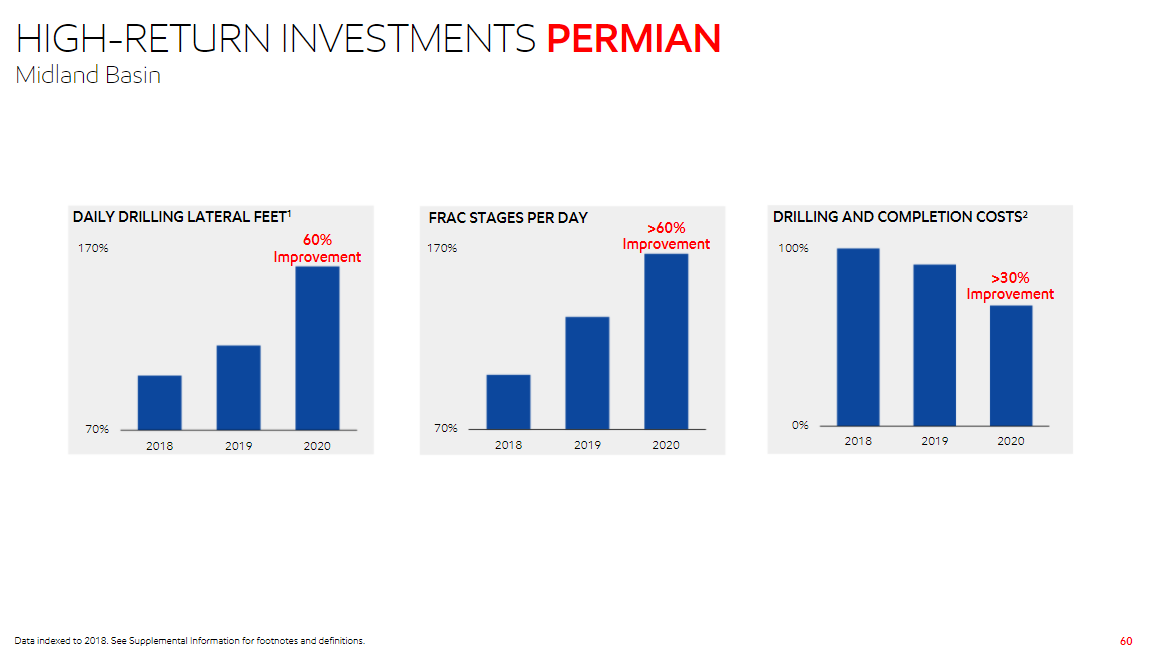

- From 2018-2020, Exxon says they improved Delaware Basin frac stages/day by over 100%, while daily drilling lateral feet came up by more than 50% over the same time frame (Midland Basin completions gains weren’t as good but Midland drilling efficiency was slightly better)

- From 2018-2020, Exxon’s Permian D&C costs fell by 40% and lease operating expenses came off by more than 35%

- Exxon has reduced flaring intensity in the Permian by 80% vs. 2018 and is moving towards zero routine flaring in operations

- NPV has increased 40% by minimizing parent-child well interference via cube development

Here are the key slides from the Exxon analyst day IR deck:

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve