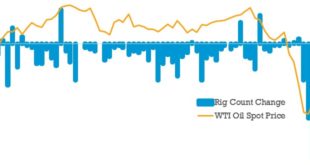

The Permian Basin rig count is down 50% from March, with little variance in the percentage decline between the Midland and Delaware Basins. But the downtrend does vary county by county… There’s a lot more to this story… Login to see the full update… To read this update and receive …

Read More »Latest Thoughts

Shape Shifting – What A Difference 10 Days Makes For The WTI Curve [Chart Of The Day]

You know it’s pretty bad when $25/bbl oil gets us excited again. But here we are, and a rally from -$37 to +$25 in the prompt month ain’t nothing! There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »Here Are The Latest Minimum Crew Counts By Company As We Follow The Frac Fleet To The Bottom

It seems like everyone from Midland to New York that cares about the oilfield market is running their own frac spread count tracker out of their quarantine quarters these days! So how about some factual inputs and validation for your own version of the latest frac action (or lack thereof)? …

Read More »Frac ‘Til May Then Go Away? E&P Budget Exhaustion Comes Early This Year

The chart below visualizes US E&P operator budgets in a very important way… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership …

Read More »Monday’s Trio Of E&P Shutdown Reports Would Be Shocking If We Weren’t Already So Desensitized To The Violence

Everywhere you look… every report you read… everyone you talk to… it’s is all telling you the same thing these days. Things are mind-numbingly bad in the US oilfield. Far worse than even the most jaded cynics expected when this crisis began. Empty highways in the Permian. Yards full of …

Read More »US Rig Count Is Cut In Half Already. How Low Can It Go? Here’s A Stab At Answering That…

Three land drillers have given rig count guidance for how far their rig counts are expected to fall by the end of 2Q20 so far. While we await the other four or five land drillers we track to report, the sum of rig count guidance so far tells us some …

Read More »Sometimes A Picture Is Worth A Thousand Words… Or A Million Horsepower

The picture you’ll find in this update might just become the iconic shot that defines this downturn – similar to those stacked rigs in that H&P yard off Business 20 in North Odessa in the last downturn… There’s a lot more to this story… Login to see the full update… …

Read More »7 Things Worth Knowing From US Silica’s Frac Sand Market Outlook

A telling photo from the field as well as 7 quick takeaways from US Silica’s conversation this morning… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »Market Intel Takeaways From The Solaris Conference Call As Wellsite Storage Systems Stack Up [Live Blog Complete + Photos From The Field]

In the company’s press release Thursday evening, Solaris said that activity could decline by 75% to 85% sequentially in the second quarter. This is in line with Infill Thinking predictions for US frac activity declines made here about three weeks ago. This deep activity cut prediction is also supported by …

Read More »What Would Texas Oil Proration Look Like? A $1,000 Fine Per Barrel For Non-Compliance Is Part Of It…

We have reviewed a draft of the proration order and share it and something that jumps out at us here… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »These E&Ps Haven’t Publicly Quantified 2020 Crisis Capex Cuts Yet [Budget Revision Watch List]

As 1Q20 E&P earnings season gets under way, there are just a handful of US E&P operators that haven’t publicly disclosed how much they’ll cut their 2020 spending programs in the wake of the crisis. There are some common traits shared by some of these companies including… a) gas exposure …

Read More »Oilfield Workforce Contraction Is 3x Deeper Than Last Downcycle Per This Metric [Depressing Chart Of The Day]

This chart is gut wrenching, and we haven’t even gotten into May and June yet, which could be even worse. Our hearts ache with the impacted oilfield workers (and their families) that make all the stuff we love to write about happen. There’s a lot more to this story… Login …

Read More »Parked. An Estimation Of W TX Frac Crew Decimation

How bad is the frac drought getting out in the Permian Basin? We discuss… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your …

Read More »No Skid Marks – Straight Down And To The Right

We are currently in the throes of the sharpest rig count contraction in history, and we expect the next several weeks to register continued large drops as the US land rig count is likely to fall sub-200. There’s a lot more to this story… Login to see the full update… …

Read More »There Is A Bright Spot In The Gloomy Lower 48 Oilpatch [Chart Of The Day + Macro Thesis Highlights]

“Give me some good news for a change,” you say? Our pleasure! Here is a chart you cannot miss because it’s all anyone’s going to be talking about as tight oil gets shut in. There’s a lot more to this story… Login to see the full update… To read this …

Read More »Paycheck Protection In The Oilfield [Chart Of The Day]

The US government has approved two rounds of “Paycheck Protection Program” (PPP) funding totaling nearly $700bn. The program offers partially forgivable loans of up to $10mm for companies with 500 or less employees. The funds are trickling into the oilfield, and rightly so. Here’s a look at the energy companies …

Read More »Even Blenders Are Working Remotely These Days… [This Week’s OFS Conference Call Takeaways]

Following the Halliburton call on Monday, we’ve heard from three more management teams this week that have no visibility on the oilfield service market outlook in 2020. That said, two of these three did say some pretty interesting things about the current market climate in the Lower 48 oilpatch. Here …

Read More »Forget Frac. EVERYONE Is Talking Storage & Shut-ins

We checked in with a whole bunch of our oilfield service and E&P contacts this week. What we heard from them sure sounds like complete capitulation in the oilfield market. The bottom is coming into focus. Here’s what folks we talk to are saying… There’s a lot more to this …

Read More »A Look Way Back In Time To The Good Old Days… Early-2020 [Top Ten 1Q20 Updates]

By The Stats – Membership Resources Provided During 1Q20 In the 90 days ended March 31, 2020, the Infill Thinking research team: published 86 independent research updates, emailed 25 original Infill Thoughts newsletters to active members, issued 14 data releases to Think Sheets® members, got in one last great member meetup …

Read More »As Bad As Paper Oil Prices Got On Monday, The Real Spot Bid Got Worse [Chart Of The Day]

You’ve gotta see this chart to believe it. Consider our minds blown. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »Oil May Be In The Gutter, But Gas Is Good! A Look At Bifurcating Rig Fortunes In The Crash

On an historic Monday when the WTI front month contract fell more than 300% into negative territory, natural gas spot prices were up 10%! Here’s a look at bifurcating fortunes by basin focus… There’s a lot more to this story… Login to see the full update… To read this update …

Read More »Halliburton Will Not Chase Market Share In The Frac Crash [Live Analysis Of Big Red’s Latest Thinking On The Lower 48]

This morning at 8am central, Halliburton will host their 1Q20 earnings call. Needless to say, their remarks on challenging Lower 48 business conditions will be closely watched. While outlook / guidance could be light since visibility is limited, we expect some good color on current market conditions to come from …

Read More »On The Oilfield’s Second Black Monday This Spring… One Word Comes To Mind: TEMPORARY

We know you know the logic, but on days like today, it’s good to read and re-read the crude oil cyclical rationale in it’s simplest form, which is as follows: There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More »Schlumberger Estimates 100+ US Frac Crews Will Still Be Active At The Bottom [Live Blog Complete]

Towards the end of Q&A during today’s call, came perhaps the most interesting thing that management said about the US market all morning. Specifically, Schlumberger was asked where the US frac fleet count might bottom. Management used the opportunity presented by this question to refute some of the doomsday frac …

Read More »A Deep Dive (& Some Fun) With The Historic Hearing On Texas Oil Cuts [Summary Of 9-Hour Testimony]

The Texas Railroad Commission (and a whole bunch of oilfield folks) had a very busy Tuesday. The three Commissioners hosted a nearly 9-hour long virtual open hearing on Tuesday, taking petitions for and against prorating Texas oil production. 20,000 viewers tuned in to watch the webcast. A whopping 53 industry …

Read More »Paper Trades Make Oil Prices Look Better Than They Are In The Physical Market… [Chart Of The Day]

Torn by two extreme market forces (oil demand destruction from the lockdown and geopolitical supplier actions), US oil prices are being distorted and dislocated beyond recognition. Here’s how the actual spot bids in the field are trending across various grades and basins (spoiler alert, it isn’t pretty and the lowest …

Read More »A 2nd Round Of Negative Revisions Well Underway As E&P Spending Cuts Now Top $25 Billion [Real-Time NAM E&P Capex Budget Monitor]

Here are the E&Ps that have publicly announced cuts in the wake of the Sunday, March 8, oil market collapse…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »Permian In-Basin Frac Sand Mine Closures Officially Begin. Here’s Who To Watch In The Next Wave Of Local Sand Capacity Reduction

This morning comes official news of the first in-basin Permian sand mine closure since Black Monday. This may be the first official Permian closure in the pandemic era, but it a) won’t be the last and b) might not be the actual first. Here’s what we are watching as the frac sand demand destruction situation …

Read More »Turbulent Waters: A Commercial Landscape Update For Water Midstream

We checked in with some of our friends at Winston & Strawn last week to get a read on commercial conditions in oilfield water. Since this team is plugged-in to water deal flow, we asked what issues their water midstream clients are seeking help with these days. What they shared …

Read More »Oilfield Hiring Is Frozen With One Exception… [Chartbook]

As this vicious downturn sends the US oilfield industry into a workforce reduction spiral, it goes without saying that hiring freezes have become the norm. Just how bad is it and are there any bright spots? We quantify the oilfield job market here… There’s a lot more to this story… …

Read More »Covia And Baker Hughes Join Ballooning List Of OFS Spending Cuts [Real-Time OFS Crisis Response Tracker]

E&P operators announced their spending cuts a week or two before most of the oilfield service industry (OFS). We are tracking the E&P capex pullbacks in real-time here, and their planned rig releases and frac crew releases too. Now it’s OFS’s turn to activate the downturn playbook and announce cost …

Read More »Imagining The Unimaginable – Here Are Our Rock Bottom Targets For The 2020 US Oilfield

Earlier this week we outlined 10 key debates that will commence as soon as the oilfield market bottoms. How will we know when the bottom is here? On what kind of stage will these debates play out? What are reasonable expectations for oilfield activity when the floor is reached? In …

Read More »US Rig Count Registers Steepest 3-Week Decline Ever

The US rig count is down 170 units in three weeks. On a percentage basis, (-22%) that is the… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Wet Sand Direct To Blender Might Be Music To Our Fracing Ears [Guest Post]

In addition to the personnel exposure benefit, the elimination of the drying process has a very real impact on energy consumption and the resulting emissions. Converting an annual operation that pumps 360,000 tons of sand dried by natural gas to a wet sand operation would reduce CO2 emissions by at …

Read More »Last Time The US Rig Count Fell This Much In Two Weeks, Richard Nixon Was President

Putting numbers to it, the total US rig count (land and offshore) fell by 108 rigs over the last two weeks, or a 14% decrease. Here’s how this crash stacks up against 70 years of US rig count history… There’s a lot more to this story… Login to see the …

Read More »When We Make It To The Other Side… The Top 10 Debates For When The NAM Oilfield Bottoms

One beaten-down reader told us last week that we need to start a virtual happy hour after every newsletter we send these days. We understand – the subject matter is indeed depressing. Recent newsletters haven’t been easy for us to ship, for we know that our writings reflect the pain …

Read More »A Watershed Moment For The Oil Market – Quick Thoughts & A Recap Of This Week’s Historic Developments

For most of the oilfield business people we know and interact with, the price of oil is noise until it isn’t. It’s one of those things that doesn’t matter until it does. And right now, it certainly does. And here’s what caught our eye in this historic week… There’s a …

Read More »Wherever Frac May Roam… Meet Nomad, A New Entrant In The Emerging Mobile Mini Frac Sand Category

We recently caught up by phone (observing social distancing) with the management team of a new entrant in the emerging mobile-mini frac sand plant market. Here’s what we learned about their plans and what they are doing differently… There’s a lot more to this story… Login to see the full …

Read More »A Seismic Investigation Of Last Week’s 5.0 Magnitude Permian Earthquake [Guest Post]

One week ago, a 5.0 magnitude earthquake rocked the state-line area of Texas / New Mexico. The strongest in the area since 2017, it was reportedly felt by thousands as far away as Odessa. Quakes often lead to hasty and uninformed conclusions about causes involving oilfield activity. Today’s guest post …

Read More »A Dystopian 2020 US Oilfield. Day-By-Day E&P Budget Cuts & A Look Ahead… [Chart Of The Day]

This piece charts the capex cuts daily so far in what can only be described as a historic, no dystopian, E&P crisis response. We also discuss what happens next with capex spending and frac crew releases and the bigger picture… There’s a lot more to this story… Login to see …

Read More »Two Permian E&Ps Call On TX RRC To Limit Oil Production While Echoing Infill Thinking’s Sub-$10 WTI Prediction

A desperate bid by two Permian operators to put a floor under the price of oil and stabilize and save the US E&P industry… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »MidCon Local Frac Sand Capacity Is Contracting Rapidly [Exclusive]

We track Xmmtpa of frac sand production capacity online in the MidCon today. We now believe that frac sand demand could sink south of Xmmtpa on an annual run rate as mid-year approaches. Here’s how local plants are reacting… There’s a lot more to this story… Login to see the …

Read More »With The Rig Count Now In Free-Fall, Here Is Some Downcycle Context

There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our current subscription options at [email protected]. (Current …

Read More »Is $20-$25/bbl WTI Just A Waypoint On The Journey To $10/bbl Or Lower? [US O&G Worst Case Scenario Thought Piece]

An important E&P capex update this week reads distinctly negative for anyone hoping for an oilfield spending increase in 2020. Here’s the relevant excerpt: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »Be Thankful I Don’t Take It All ‘Cause I’m the Taxman [Friday Guest Post]

While you fight for the survival of your business, the assessor is doing his/her job and preparing notices of property assessments. Those assessment notices will reflect the idyllic conditions back on January 1, 2020. There’s a lot more to this story… Login to see the full update… To read this …

Read More »COVID-19 Blamed For Work Stoppages At Several Frac Jobs This Week [Exclusive]

Frac disruption and inefficiency is on the rise as workers show symptoms or test positive for COVID-19… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More »Infill Thinking Offers Relief To Laid-off Members

Unfortunately, thousands of extremely talented and dedicated oilfield business people are being let go right now through no fault of their own. So this week, Infill Thinking will begin offering 90-days free access to any oilfield business people let go from their position in these uncertain times. By offering furloughed …

Read More »E&Ps Are Hardstopping US Oilfield Activity [Voice Of The Industry Survey From The Past 7 Surreal Days]

Here’s what we heard during phone calls with many of our oilfield contacts over the past 7 days: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »The Leading US Land Rig Contractor Reacts As The Drilling Nosedive Begins

Friday March 20, 2020 is the day the land rig count collapse began. Last Friday, rig count was down 20 units with the Permian leading the way down (-10 rigs). Here’s what the market leader said in reaction to the beginning of this unprecedented crash…. There’s a lot more to …

Read More »Tallying Up The Known Frac Crew Releases For The Public E&Ps

There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our current subscription options at [email protected]. (Current …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve