“Give me some good news for a change,” you say? Our pleasure! Here is a chart you cannot miss because it’s all anyone’s going to be talking about as tight oil gets shut in. There’s a lot more to this story… Login to see the full update… To read this …

Read More »Latest Thoughts

Paycheck Protection In The Oilfield [Chart Of The Day]

The US government has approved two rounds of “Paycheck Protection Program” (PPP) funding totaling nearly $700bn. The program offers partially forgivable loans of up to $10mm for companies with 500 or less employees. The funds are trickling into the oilfield, and rightly so. Here’s a look at the energy companies …

Read More »Even Blenders Are Working Remotely These Days… [This Week’s OFS Conference Call Takeaways]

Following the Halliburton call on Monday, we’ve heard from three more management teams this week that have no visibility on the oilfield service market outlook in 2020. That said, two of these three did say some pretty interesting things about the current market climate in the Lower 48 oilpatch. Here …

Read More »Forget Frac. EVERYONE Is Talking Storage & Shut-ins

We checked in with a whole bunch of our oilfield service and E&P contacts this week. What we heard from them sure sounds like complete capitulation in the oilfield market. The bottom is coming into focus. Here’s what folks we talk to are saying… There’s a lot more to this …

Read More »A Look Way Back In Time To The Good Old Days… Early-2020 [Top Ten 1Q20 Updates]

By The Stats – Membership Resources Provided During 1Q20 In the 90 days ended March 31, 2020, the Infill Thinking research team: published 86 independent research updates, emailed 25 original Infill Thoughts newsletters to active members, issued 14 data releases to Think Sheets® members, got in one last great member meetup …

Read More »As Bad As Paper Oil Prices Got On Monday, The Real Spot Bid Got Worse [Chart Of The Day]

You’ve gotta see this chart to believe it. Consider our minds blown. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »Oil May Be In The Gutter, But Gas Is Good! A Look At Bifurcating Rig Fortunes In The Crash

On an historic Monday when the WTI front month contract fell more than 300% into negative territory, natural gas spot prices were up 10%! Here’s a look at bifurcating fortunes by basin focus… There’s a lot more to this story… Login to see the full update… To read this update …

Read More »Halliburton Will Not Chase Market Share In The Frac Crash [Live Analysis Of Big Red’s Latest Thinking On The Lower 48]

This morning at 8am central, Halliburton will host their 1Q20 earnings call. Needless to say, their remarks on challenging Lower 48 business conditions will be closely watched. While outlook / guidance could be light since visibility is limited, we expect some good color on current market conditions to come from …

Read More »On The Oilfield’s Second Black Monday This Spring… One Word Comes To Mind: TEMPORARY

We know you know the logic, but on days like today, it’s good to read and re-read the crude oil cyclical rationale in it’s simplest form, which is as follows: There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More »Schlumberger Estimates 100+ US Frac Crews Will Still Be Active At The Bottom [Live Blog Complete]

Towards the end of Q&A during today’s call, came perhaps the most interesting thing that management said about the US market all morning. Specifically, Schlumberger was asked where the US frac fleet count might bottom. Management used the opportunity presented by this question to refute some of the doomsday frac …

Read More »A Deep Dive (& Some Fun) With The Historic Hearing On Texas Oil Cuts [Summary Of 9-Hour Testimony]

The Texas Railroad Commission (and a whole bunch of oilfield folks) had a very busy Tuesday. The three Commissioners hosted a nearly 9-hour long virtual open hearing on Tuesday, taking petitions for and against prorating Texas oil production. 20,000 viewers tuned in to watch the webcast. A whopping 53 industry …

Read More »Paper Trades Make Oil Prices Look Better Than They Are In The Physical Market… [Chart Of The Day]

Torn by two extreme market forces (oil demand destruction from the lockdown and geopolitical supplier actions), US oil prices are being distorted and dislocated beyond recognition. Here’s how the actual spot bids in the field are trending across various grades and basins (spoiler alert, it isn’t pretty and the lowest …

Read More »A 2nd Round Of Negative Revisions Well Underway As E&P Spending Cuts Now Top $25 Billion [Real-Time NAM E&P Capex Budget Monitor]

Here are the E&Ps that have publicly announced cuts in the wake of the Sunday, March 8, oil market collapse…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »Permian In-Basin Frac Sand Mine Closures Officially Begin. Here’s Who To Watch In The Next Wave Of Local Sand Capacity Reduction

This morning comes official news of the first in-basin Permian sand mine closure since Black Monday. This may be the first official Permian closure in the pandemic era, but it a) won’t be the last and b) might not be the actual first. Here’s what we are watching as the frac sand demand destruction situation …

Read More »Turbulent Waters: A Commercial Landscape Update For Water Midstream

We checked in with some of our friends at Winston & Strawn last week to get a read on commercial conditions in oilfield water. Since this team is plugged-in to water deal flow, we asked what issues their water midstream clients are seeking help with these days. What they shared …

Read More »Oilfield Hiring Is Frozen With One Exception… [Chartbook]

As this vicious downturn sends the US oilfield industry into a workforce reduction spiral, it goes without saying that hiring freezes have become the norm. Just how bad is it and are there any bright spots? We quantify the oilfield job market here… There’s a lot more to this story… …

Read More »Covia And Baker Hughes Join Ballooning List Of OFS Spending Cuts [Real-Time OFS Crisis Response Tracker]

E&P operators announced their spending cuts a week or two before most of the oilfield service industry (OFS). We are tracking the E&P capex pullbacks in real-time here, and their planned rig releases and frac crew releases too. Now it’s OFS’s turn to activate the downturn playbook and announce cost …

Read More »Imagining The Unimaginable – Here Are Our Rock Bottom Targets For The 2020 US Oilfield

Earlier this week we outlined 10 key debates that will commence as soon as the oilfield market bottoms. How will we know when the bottom is here? On what kind of stage will these debates play out? What are reasonable expectations for oilfield activity when the floor is reached? In …

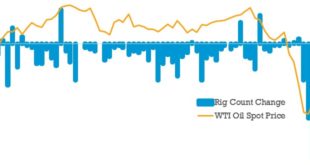

Read More »US Rig Count Registers Steepest 3-Week Decline Ever

The US rig count is down 170 units in three weeks. On a percentage basis, (-22%) that is the… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Wet Sand Direct To Blender Might Be Music To Our Fracing Ears [Guest Post]

In addition to the personnel exposure benefit, the elimination of the drying process has a very real impact on energy consumption and the resulting emissions. Converting an annual operation that pumps 360,000 tons of sand dried by natural gas to a wet sand operation would reduce CO2 emissions by at …

Read More »Last Time The US Rig Count Fell This Much In Two Weeks, Richard Nixon Was President

Putting numbers to it, the total US rig count (land and offshore) fell by 108 rigs over the last two weeks, or a 14% decrease. Here’s how this crash stacks up against 70 years of US rig count history… There’s a lot more to this story… Login to see the …

Read More »When We Make It To The Other Side… The Top 10 Debates For When The NAM Oilfield Bottoms

One beaten-down reader told us last week that we need to start a virtual happy hour after every newsletter we send these days. We understand – the subject matter is indeed depressing. Recent newsletters haven’t been easy for us to ship, for we know that our writings reflect the pain …

Read More »A Watershed Moment For The Oil Market – Quick Thoughts & A Recap Of This Week’s Historic Developments

For most of the oilfield business people we know and interact with, the price of oil is noise until it isn’t. It’s one of those things that doesn’t matter until it does. And right now, it certainly does. And here’s what caught our eye in this historic week… There’s a …

Read More »Wherever Frac May Roam… Meet Nomad, A New Entrant In The Emerging Mobile Mini Frac Sand Category

We recently caught up by phone (observing social distancing) with the management team of a new entrant in the emerging mobile-mini frac sand plant market. Here’s what we learned about their plans and what they are doing differently… There’s a lot more to this story… Login to see the full …

Read More »A Seismic Investigation Of Last Week’s 5.0 Magnitude Permian Earthquake [Guest Post]

One week ago, a 5.0 magnitude earthquake rocked the state-line area of Texas / New Mexico. The strongest in the area since 2017, it was reportedly felt by thousands as far away as Odessa. Quakes often lead to hasty and uninformed conclusions about causes involving oilfield activity. Today’s guest post …

Read More »A Dystopian 2020 US Oilfield. Day-By-Day E&P Budget Cuts & A Look Ahead… [Chart Of The Day]

This piece charts the capex cuts daily so far in what can only be described as a historic, no dystopian, E&P crisis response. We also discuss what happens next with capex spending and frac crew releases and the bigger picture… There’s a lot more to this story… Login to see …

Read More »Two Permian E&Ps Call On TX RRC To Limit Oil Production While Echoing Infill Thinking’s Sub-$10 WTI Prediction

A desperate bid by two Permian operators to put a floor under the price of oil and stabilize and save the US E&P industry… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »MidCon Local Frac Sand Capacity Is Contracting Rapidly [Exclusive]

We track Xmmtpa of frac sand production capacity online in the MidCon today. We now believe that frac sand demand could sink south of Xmmtpa on an annual run rate as mid-year approaches. Here’s how local plants are reacting… There’s a lot more to this story… Login to see the …

Read More »With The Rig Count Now In Free-Fall, Here Is Some Downcycle Context

There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our current subscription options at [email protected]. (Current …

Read More »Is $20-$25/bbl WTI Just A Waypoint On The Journey To $10/bbl Or Lower? [US O&G Worst Case Scenario Thought Piece]

An important E&P capex update this week reads distinctly negative for anyone hoping for an oilfield spending increase in 2020. Here’s the relevant excerpt: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »Be Thankful I Don’t Take It All ‘Cause I’m the Taxman [Friday Guest Post]

While you fight for the survival of your business, the assessor is doing his/her job and preparing notices of property assessments. Those assessment notices will reflect the idyllic conditions back on January 1, 2020. There’s a lot more to this story… Login to see the full update… To read this …

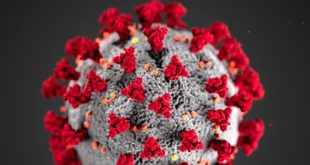

Read More »COVID-19 Blamed For Work Stoppages At Several Frac Jobs This Week [Exclusive]

Frac disruption and inefficiency is on the rise as workers show symptoms or test positive for COVID-19… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More »Infill Thinking Offers Relief To Laid-off Members

Unfortunately, thousands of extremely talented and dedicated oilfield business people are being let go right now through no fault of their own. So this week, Infill Thinking will begin offering 90-days free access to any oilfield business people let go from their position in these uncertain times. By offering furloughed …

Read More »E&Ps Are Hardstopping US Oilfield Activity [Voice Of The Industry Survey From The Past 7 Surreal Days]

Here’s what we heard during phone calls with many of our oilfield contacts over the past 7 days: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »The Leading US Land Rig Contractor Reacts As The Drilling Nosedive Begins

Friday March 20, 2020 is the day the land rig count collapse began. Last Friday, rig count was down 20 units with the Permian leading the way down (-10 rigs). Here’s what the market leader said in reaction to the beginning of this unprecedented crash…. There’s a lot more to …

Read More »Tallying Up The Known Frac Crew Releases For The Public E&Ps

There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our current subscription options at [email protected]. (Current …

Read More »Insuring The Frac Supply Chain’s Last Mile In A World Of Nuclear Verdicts And Vicarious Liability [Friday Guest Post]

Earlier this week, another trucking company’s nuclear verdict made headlines, this one outside of the frac sand hauling industry but notable none-the-less. While definitions can vary, a “nuclear verdict” is generally thought of as a jury award where the penalty exceeds $10 million. Nuclear verdicts have driven insurance premiums for …

Read More »For The US Land Rig Count, It’s The Calm Before The 100-Year Storm [Weekly Rig Count]

The Baker Hughes US land rig count on Friday (+3) did not yet reflect the releases that operators are planning. Calm before the storm? Here’s everyone that’s disclosed plans to release rigs…. There’s a lot more to this story… Login to see the full update… To read this update and …

Read More »Seems Impossible, But Things Got Worse Between Black Monday & Friday The Thirteenth [Notes From The Field]

As last week wore on, we had hoped it would get better. It did not. We had also hoped that our initial concern expressed on Tuesday was overstated when we wrote then that the swiftest shale pullback in history could be imminent. It was not. As the week wore on, …

Read More »Flu Fear On The Frac Site

If this virus can can shut down Major League Baseball and Disney Land, why should we expect that frac sites will be any different and stay open as virus reaction spreads? If this virus can empty dormitories because of spreading risk in close quarters, what about man camps? Here’s what …

Read More »Factoring 2020 DOT Drug & Alcohol Reg Changes Into Frac’s Last Mile [Friday Guest Post]

When Phil Baxter recently asked me if I had looked into the big changes that were made in January to the FMSCA’s drug and alcohol policies (and the impact they could have on hauling capacity in the frac supply chain), I perked up and asked if he’d chime in on …

Read More »NPR Marketplace Cites Infill Thinking’s ‘Double Black Swan’ Report In Coverage Of The Oil Price Fall-out

On March 9, 2020, National Public Radio’s Marketplace show aired a segment across >800 US radio stations about the oil price fall-out’s impact on US oilfield activity. Their piece draws insights from our research update published for Infill Thinking subscribers earlier that day titled “On Black Monday, A Double Black …

Read More »US Tight Oil E&Ps React Swiftly, Decisively To SLAM The Brakes

It’s been 36 hours since the oil industry’s D-Day equivalent, and US E&P operators are wasting no time cutting activity… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »The First Consolidation Deal In Oilfield Service Since Everything Changed Over The Weekend

There is one less independent wellsite storage firm operating in the Lower 48 today after a legal battle culminated in a takeover that will see the fleet change hands. There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »On Black Monday, A Double Black Swan Leaves Us Staring Into A Black Abyss

“It’s always darkest before it goes completely black.” – Sen. John McCain We digest the implications of the market fallout and think through some things that matter for business leaders in the oilfield at its darkest hour… There’s a lot more to this story… Login to see the full update… …

Read More »Corona On Our Minds [Friday Guest Post]

Guest Contributor Introduction From Joseph Triepke: Today’s guest post has been three years in the making. Allow me to explain…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »Don’t Conflate Exxon’s Big Permian Rig Count Chop With Completions [Analyst Day Takeaways]

Within minutes of the transcript of the Exxon analyst day being released, we shared this summary of what’s new in the company’s Permian Basin Drilling & Completion outlook…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »A Brief History Of The Flaring Dialog Between E&P CEOs & Investors

In a separate update earlier this week, we quantified a new kind of flaring intensity index. Today we explore the qualitative side of this trend, distilling over 1,000 executive/investor conversations about flaring over the past decade and a half into this 5-minute-read summary. There’s a lot more to this story… …

Read More »The Customer Is Always Right, And Here Are The Most Notable Things Frac Sand Customers Said In February

EOG said recently that better pairing of origin and destination vs. 2019 will help them achieve targeted well cost savings. We wonder if this is simply better availability of local sand near their wells or possibly mobile mini plant adoption? Here is the key quote as well as other interesting …

Read More »Corona Quote Of The Day From An Energy CEO Who Believes People Are Overreacting

Here’s what one energy CEO very candidly told investors in Vail this week about how he thinks the broader public and O&G industry is overreacting to fear surrounding the coronavirus… There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve