Contrary to the click bait proliferating on other media platforms, US oil producers are not slashing 2017 tight oil investment programs as a result of recent crude oil price volatility. Anadarko’s US onshore investment revision, which became the poster child for so called shale budget cuts this week, is grossly misunderstood. Not only …

Read More »Latest Thoughts

Who Doesn’t Have A Permian Sand Mine These Days? Why Not? [Notable Absence List]

As the list of “haves” grows longer, now seems like a good time to ask this question: who hasn’t joined in the rush and why not? Our inverted Permian mine list may actually be more interesting at this juncture than widely known announced facilities. There’s a lot more to this story… …

Read More »Badger Mining Joins The Kermit Sand Rush

The latest details on the latest new entrant to the Permian sand mining rush… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your …

Read More »Anadarko Says Less Sand/Well Tests Positive In The Rockies – This Adds Fuel To The Fire Halliburton Started Yesterday

The discussion around plateauing (wait… make that falling) frac sand/well is heating up. What’s new and what we think about it here. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »Big Red And Big Blue Disagree On Rig Count Outlook… But Not Like They Normally Do.

Halliburton and Schlumberger have given two distinctly different outlooks on US rig count direction for the next three to six months over the past two business days. Interestingly, their arguments have departed from their normal advocacy tendencies. See how and who we agree more with in this update. There’s a …

Read More »Halliburton… Just The Non-Sand Stuff Like Hiking Wages, Pushing Pricing, & Adding Horsepower

Halliburton’s frac sand statements overshadowed some really important Lower 48 market updates yesterday. Here are the key non-sand points that caught our attention: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »Permian Sand Mining Rush Makes The Front Page Of The Sunday Paper [Link]

The Permian Basin frac sand story is receiving attention from the local press out in West Texas. Some interesting incremental color emerged… feature image photo credit: Hi Crush’s Kermit site on Sunday July 24, 2017 front page of Odessa American There’s a lot more to this story… Login to see …

Read More »Halliburton Drops A Sand Bomb, But Is It Signal Or Noise?

It’s a sign of the times. Frac sand controversy on Halliburton’s earnings conference call Monday overshadowed everything else, including some interesting points on pressure pumping dynamics, rig count brake tapping, international service pricing trends, and higher wages. We’ll address Big Red’s “non-sand” comments in a separate update later today. These …

Read More »Fairmount Santrol Announces New Texas Sand Plant, Confirming Previous Infill Thinking Reports

An infill Thinking prediction was confirmed this morning as the Permian Basin sand rush continues to heat up… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »Schlumberger Just Delivered The Best Macro Summary We’ve Heard In A Long Time

Schlumberger kicked off oilfield service earnings this morning. Everything you need to know about the tone they set is right here. Also, don’t miss the biggest takeaways of the day where Schlumberger’s CEO said… There’s a lot more to this story… Login to see the full update… To read this …

Read More »Trucking All That Kermit Sand: Hidden Delays & Major Routes [Part 1]

Today we are kicking off a two part series addressing the trucking needs for yet-to-be-produced Permian Basin frac sand. In this installment, we have maps of the mines vs. major trucking routes to well sites. We have also recorded some thoughts on the hidden logistics challenges that no one is …

Read More »EnerVest Tries To Reassure Its Riled Supply Chain After WSJ Hit Piece [Email & Counterparty List]

The Wall Street Journal knows how to title a hit piece. After their article saying EnerVest is worthless, the company is scrambling to reassure its fearful supply chain. See who works for the operator and read EnerVest’s crisis management response in this update. There’s a lot more to this story… …

Read More »Permian Drilling Permits Finally Falter. Signal Or Noise?

We take a look at drilling permit demand in the hottest oilfield in the world. What does it mean for what comes next? Also, our regular weekly tables and charts derived by applying a little infill thinking and elbow grease to Baker Hughes rig count data. There’s a lot more …

Read More »As A Kermit Sand Plant Posts 75 Job Openings, We Update Our Mine New Hire Estimates

Staffing up the new Permian frac sand mines is a challenge we first wrote about back in May. Lately, we’ve heard and seen more sand producers highlighting the issue as a barrier to entry (example). In this update, we share the latest on who’s hiring, how they are doing it, …

Read More »Equipment Manufacturer Optimism Signals Elevated Risk For Frac NPT Ahead

On Monday, we learned that a UK frac equipment manufacturer is outperforming. Learn why and what it means for the US frac equipment supply chain in this update. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »There Are More Mines Coming Soon To A Dune Near You. “Planned” Permian Capacity Now Exceeds Demand Forecasts

Last week, we published a current snapshot of the Permian Basin sand picture which subscribers can download in excel. This is an accurate snapshot of “known” future in-basin mines; however, we encourage readers to remain vigilant and not get too comfortable with any analyst’s estimates of planned in-basin capacity just yet. …

Read More »Is Recovery Outside The USA A Lost Cause This Cycle? [New Discussion Topic]

There’s a new discussion topic posted in the Thinking Aloud forum. Most of our focus at InfillThinking.com this year has been on the Lower 48. That’s because most everything else is flat to down. With the oil price outlook under pressure and only the US tight oil plays growing, it’s time …

Read More »Lizard vs. Mine – This Is A Big Deal That Rallied O&G Leaders In Midland This Week

Despite the potentially wide ranging impact on industry activities next year, the lizard’s crawl back into the spotlight has been accompanied by very little fanfare. Outside of a few plugged-in Permian E&P leaders and some of the more cerebral in-basin sand producers, we don’t believe this topic has gotten the …

Read More »Permian Sand Mine Refresh: All The New Sites In An Excel Download

The Permian frac sand mine story has been moving at light speed. During conversations with several readers this week, we simply paused and marveled at the pace of newsflow in this trend. Even for those of us that keep up with the story very closely, reference points can quickly become …

Read More »What’s Next For Devon After A Record-Setting STACK Well? Watch Showboat Spud [Follow The Leaders]

Record setting STACK well results announced by Devon on Tuesday morning bode well for what the operator has planned next – a transition to full field, multi-zone manufacturing starting at a nearby location. We share our cliff notes on Devon’s pivotal Showboat project, which spuds imminently. There’s a lot more …

Read More »First Look At 2018 US E&P Capex & Rig Count: Flat At The Current Strip?

While the majors talk capex in terms of multi-year programs, the Independents that drive the Lower 48 drilling & completion markets are usually reticent to discuss specific year-ahead capex details until budget season (late-4Q / early 1Q). Last week an Independent talked specifics on their 2018 development plan – one …

Read More »Another Day, Two More New Permian Sand Mines (Including The Biggest Yet)

Just when you thought it couldn’t get any hotter, the Permian frac sand rush heated up again this week. Two more mine sites were announced in the Permian on Thursday, including the largest to date. We now count 11 “firm” Permian mine sites, with rumors floating around of at least …

Read More »Don’t Read Too Much Into The Two Artificial Lift Transactions This Week

On the same day this week, both Halliburton and Forum Energy Technologies made acquisitions in the artificial lift space. Specifically, each firm announced a deal to take out a privately held electric submersible pump (ESP) target. The coincidental timing and shared ESP focus of the deals has inspired some exaggerated …

Read More »The Top Infill Thinking Stories, Charts, And Debates Of 2Q17

Infill Thinking membership tripled over the past three months. Before we review 2Q17 research highlights, here is some color on readership. As of July 2017, Infill Thinking readership is comprised of analysts, business people, and executives categorized as follows: If you haven’t subscribed (or renewed your free trial yet), please …

Read More »The Reconstruction Of The Jackup Market [Guest Post]

Deepwater attracts most of the attention paid to offshore drilling, but shallow water rig demand has improved recently stirring up some hope that perhaps the jackup segment may offer better relative recovery prospects offshore. We asked Infill Thinking subscriber Liz Tysall (a Senior Rystad Energy Analyst who has been following …

Read More »Recent History Says US Rig Count Will Roll Over In August If Oil Falls Sub-$40

With oil prices falling, it is worth noting what historical oil price / rig count relationships suggest about future drilling activity. In this update, we examine the oilfield reaction times that can be expected when oil prices move. There’s a lot more to this story… Login to see the full …

Read More »How Far Can Shale Grow On Run Flat Tires?

E&P transcripts we’ve seen from recent investor conferences have been pretty upbeat all things considered. Why? Oil prices are sub-$45 and under pressure. Well, shale has some tricks up its sleeve that allow it to keep going, and we break them down here. There’s a lot more to this story… …

Read More »US Silica Files Permian Mine Permit

Back on June 12 US Silica announced their entrance into the Permian Basin frac sand mining space. This week, new details have emerged… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »Hi-Crush Permian Frac Sand Mine Progress Picture

A quick update on Hi-Crush’s new Permian mine here – specifically a picture shared with us taken from just outside their facility a few days ago. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »Permian Basin Leading Indicator Strengthens In June Despite Macro Headwinds [Charts]

For this update we took a quick look at month-to-date horizontal drilling permitting activity in the Permian Basin. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »Indirect/Hidden Costs Are Posing An Increasing Threat To E&P [Guest Post]

Each Friday in June, we are passing the keyboard to one of our readers to share perspective from the field. We have handpicked these experts in their fields to share insights on key oilfield trends and debates. In today’s piece, online marketplace RigUp offers cost and market transparency on the Lower …

Read More »Wall Street Blames Shale, But Shale Points The Finger Right Back

Reacting to the crude price blood bath on their screens, dozens of Wall Street research shops are blasting bearish notes to institutional investor clients as we write. There is a common thread in every one of these notes that we’ve seen. Wall Street analysts blame relentless US tight oil producers …

Read More »The Largest Gas Producer Endorses A Conservative Unconventional Movement In The Shale Gas Revolution [Follow The Leaders]

Infill Thinking’s Follow The Leaders series distills key unconventional E&P strategies into real-time, digestible updates. The goal? Uncover future business opportunities and risks. Today we take a look at a new value creation strategy outlined by the leader in natural gas. The meaning of value creation in shale gas has changed. There’s a lot …

Read More »Marcellus Scale – A Glance At The EQT / Rice Deal From A Well-Site Demand Perspective

Yesterday morning, EQT consolidated the Marcellus Shale by acquiring Rice Energy for $6.7bn in a deal that creates the largest natural gas producer (>3Bcfpd) in the US. The deal is expected to close in 4Q17. The combination and new strategic direction for the combined operator has material implications for the …

Read More »Permian Frac Sand Mine Scattershooting Part 2

Over the past several weeks, we have spoken with many industry contacts close to the Permian Basin frac sand mining scene. Our channel checks have revealed insights on geology, plant progress, challenges, tone shift, and contracting activity. In a two part series starting last week and concluding today, we are …

Read More »With US E&P Sentiment Hinging On $45 Crude, A Top Five Pressure Pumper Is Already Pulling Back

Everything seems lined up for an incredible 2H17 for US completion service providers. Everything except for oil prices. In a week of rampant pessimism, our obligatory negative post introduces several new developments you won’t read about anywhere else including what one of the biggest pressure pumpers in the market is telling …

Read More »Henry Ford Didn’t Build A Faster Horse And Neither Should You – 3 Big Data Mistakes The Oilfield Keeps Making [Guest Post]

The big data hype machine can be powerful, and it’s tempting to believe that building and maintaining an effective analytic capability is effortless, with limitless benefits. Today, every company in the oilfield is in the midst of a tech / big data / automation overhaul. In this guest post, Steve …

Read More »Permian Frac Sand Mine Scattershooting Part 1

Over the past several weeks, we have spoken with many industry contacts close to the Permian Basin frac sand mining scene. Our channel checks have revealed insights on geology, plant progress, challenges, and contracting activity. In a two part series starting today and concluding next week, we are chronicling some …

Read More »DUCs Have Built A Nice Tailwind For 2H17 Frac Demand. The Permian Stands Head And Shoulders Above The Rest [6 Charts]

We don’t take the EIA data on completions and DUCs (drilled but uncompleted wells) at face value. But we do look at their work for directional trends on DUCs, which can be a good leading indicator for trends in frac horsepower demand. In this update, you’ll find our analysis of this week’s …

Read More »US Silica Makes An Expected Entrance Into The Permian Sand Race

On Monday after the close, US Silica announced that they will built a 4mmtpa plant “equidistant to the hearts of both the Delaware and Midland Basins.” We break down what you need to know and provide context on this announcement. There’s a lot more to this story… Login to see the …

Read More »The US Rig Count Just Hit Halliburton’s “Equilibrium Point”

Last week, the US land rig count breached 900 (stands at 902). We are now at the level Halliburton famously pronounced “the new equilibrium” one year ago. We address what this means for completions, frac horsepower, and US oil production in this update. There’s a lot more to this story… Login to see the …

Read More »When It Comes To Managing Drillship Effective Supply, Contractors Are Playing A Game Of Convict Poker [Guest Post]

Each Friday in June, we are passing the keyboard to one of our readers to share perspective from the field. This week, Ron Davis weighs on on a classic business conundrum in deepwater. The drilling contractors have, in an effort to downplay the daunting oversupply (and possibly drive down distressed …

Read More »Payback’s A Rig. US/Saudi Drilling Reversal Continues, Bodes Well For OPEC Quota Compliance

A dramatic run up in the Saudi Arabian rig count preceded the OPEC November 2014 decision to become a price taker and defend market share. This of course triggered the biggest collapse in US drilling history. The decision to extend OPEC quotas in May was in fact predicted by just …

Read More »Mammoth Prices A 3-Year Take Or Pay Frac Sand Contract At $44/ton

Mammoth Energy Services announced Thursday that it has signed a three-year take or pay deal to provide Wisconsin frac sand to an undisclosed pressure pumper. The contract contemplates annual volumes of 720,000 tons comprised of several different grades including 20/40, 30/50, and 40/70. We have thoughts on pricing relative to recent benchmarks, what …

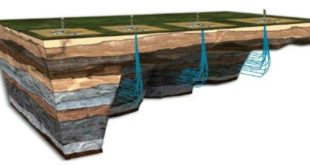

Read More »Frac Sand Is A Substitute For Wells And Rigs. Lower 48 Surface Sprawl Is Going Underground [Charts]

Is frac sand replacing rigs? It would appear so in the US onshore recovery. As unconventional drilling and completion science evolves, the industry’s surface footprint per barrel of oil produced is shrinking. A growing sub-surface footprint (which we can measure with sand) is replacing the surface sprawl. With the US onshore …

Read More »Food For Thought: How Much Of The US Recovery Is Being Paid For With Other People’s Money?

There is a new discussion topic posted in our Thinking Aloud forum today. In it we have seeded the conversation on: E&P outspending (capex vs. cash flow) behavior historically, Considerations for how much of the US onshore rig count surge is self-funded, and Thoughts on how long outspending by US …

Read More »More Rigs Have Been Activated In Reeves County This Year Than In The Entire Bakken

In the Permian Basin, horizontal drilling activity is up 101 rigs so far this year. This is more than 2x the next fastest growing play (Eagle Ford +41). In this week’s Infill Thinking rig count update, we get granular on Permian growth. We’ve ranked the counties across the Permian’s basin trifecta …

Read More »For Most Sand Miners, This Bad News Is Actually Good

Is it counterintuitive to view a court ruling against an industry participant’s expansion plans as a good thing? Yes. However, in a niche where oversupply fears have crushed the stocks of publicly traded incumbents, maybe a legal governor on the expansion plans of the few can serve the greater good. …

Read More »Do Turbulent Times Spell Increased Litigation In Oil & Gas? [Guest Post]

Each Friday in June, we are passing the keyboard to one of our readers to share perspective from the field. We have handpicked these experts in their fields to share insights on key oilfield trends and debates. Writing in from the east coast of Canada, Jonathan Dunnett kicks off our Fridays …

Read More »EOG Resources On Multi-Laterals, The Next Big Thing, & Competitive Advantage In Shale [Follow The Leaders]

Over the past two weeks, three different EOG execs spoke at three different investor conferences. Reviewing their commentary and separating signal from noise, here’s the latest on this E&P leader’s field tactics and development strategy. There’s a lot more to this story… Login to see the full update… To read this update …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve