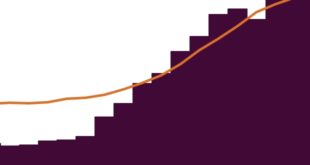

We believe the recent surge of returns-focus rhetoric from E&Ps is having a considerable impact on consensus expectations for US shale E&P spending. This was evident in our recent survey, where participants expressed a bullish view on y/y oil price trends yet waxed conservative on the spending outlook.

In this update we take a look at a chart that quantifies a dramatic E&P tone shift and go on the record with a non-consensus E&P capex forecast for 2018.

There’s a lot more to this story…

Login to see the full update…

Members get:

- Exclusive research update newsletters

- High-caliber, data-driven analysis and boots-on-the-ground commentary

- New angles on stories you’ll only find here

- No advertisements, no noise, no clutter

- Quality coverage, not quantity that wastes your time

- Downloadable data for analysts

Contact us to learn about signing up! [email protected]

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve