We had expected and modeled a significant spending decline, but not quite this big. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or …

Read More »Exxon Unveils More Detail On Their Pet Coke Proppant – Cost, Supply Chain, Scale, Patents, And Effects

More analysis of Exxon’s proppant commentary this week. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us …

Read More »E&P Inflation Projections Given This Earnings Season Are Right In Line With Infill Thinking’s October Survey Data

How do the inflation expectations being outlined by E&Ps this earnings season compare to our recent survey results? We discuss along with company-specific datapoints in the full update… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Price Hikes Are Indeed Killing E&P Capex [2022 E&P Thesis Tracking]

One of our E&P thesis coming into 2022 is that well cost inflation will surprise to the upside, putting E&Ps between a rock and a hard place. This is happening now. There’s a lot more to this story… Login to see the full update… To read this update and receive …

Read More »Exxon’s Latest Thinking On Permian Basin Development

Exxon held their annual analyst day in early-March and released a 75-slide IR deck for the event. After wading through the first twenty slides on “new energy” (hydrogen, carbon capture, solar, wind, climate change etc.), we did find some slides that shed new light on the oil major’s plans for …

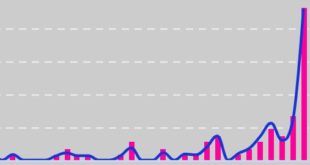

Read More »The 2021 Public E&P Spending Situation [Charts Of The Day]

Here are three charts updating the public E&P spending situation for tight oil, nat gas, and total Lower 48 in 2021 leveraging the latest Lium data with almost all the publics having now firmed up 2021 budgets and given 2020 actuals. There’s a lot more to this story… Login to …

Read More »Positive Read-Through For Both Felix Water And WPX 2020 Capex From Monday’s Big E&P M&A Deal

The dust is settling on another big E&P M&A announcement in 2019, and this one has implications for related water and midstream deal processes as well as 2020 E&P capex spending in the Permian. There’s a lot more to this story… Login to see the full update… To read this …

Read More »US E&P Budgets Sink Sharply Into The Red, But Devon’s Delaware Plan Is A Bright Spot

Over the past several days, E&P capex budget news has been categorically negative. Some of the biggest cuts we’ve seen yet have been announced while other E&Ps have cut back their preliminary 2019 spending guidance. Check out the latest budgets and totals we are are tracking here… There’s a lot …

Read More »2019 US Onshore E&P Budgets Starting To Fade In Aggregate [Updated Table]

Some of the most important numbers of early-2019 are trickling out and we’re tracking them here so you don’t have to. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you …

Read More »Is It Really Different This Time? [Chart Of The Day]

We believe the recent surge of returns-focus rhetoric from E&Ps is having a considerable impact on consensus expectations for US shale E&P spending. This was evident in our recent survey, where participants expressed a bullish view on y/y oil price trends yet waxed conservative on the spending outlook. In this …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve