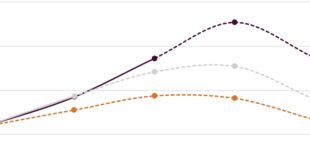

In an Infill Thinking data update, we take a look at what’s left in the tank for 2023… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Shale E&P Capex Shape Curve Skews Front-End Loaded In 2023 [Chart Of The Day]

Thoughts on E&P spending for 2023… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss …

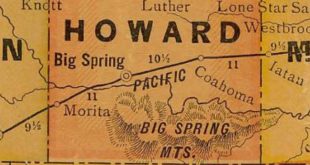

Read More »A Super Major Would Still Add Permian Rigs & Frac Crews Over The Next Couple Years At $60 Oil

We digest big plans from a big E&P pertaining to the Permian into a digestible summary… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »Mapping The Public OFS Universe’s Customer Concentration From Disclosures

Thoughts on the importance of certain customers to certain OFS providers… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »Shale E&P Capex Is Coming In Hot [Chart Of The Day]

Thoughts on E&P spending for 2023… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss …

Read More »So Much For Capital Discipline Part 2… The Budgets & Costs Keep Going Up, Oil Prices Don’t

We think E&P behavior on capex this year exhibits signs of reversion to historical norms, albeit with less leverage than in the past, which is a positive sign for OFS firms because their price increases are translating to more capital not lower activity. There’s a lot more to this story… …

Read More »So Much For Capital Discipline… E&Ps Repeatedly Hiked 2022 Budgets & Completed More Wells As Costs Soared

Although E&P management teams continue to spike the football about their capital discipline on earnings calls, capital budget and spending data tell a different story in shale. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you …

Read More »New Red Flags Raised In Permian E&P – Production Treadmill Speeding Up & Getting More Expensive?

A series of negatives for an E&P raises some red flags along the Permian’s oil production development path. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »Thoughts On The Private E&P Wildcard In The 2023 Completions Outlook

We examine Private E&P behavior and what they might do next as they have an increasingly large role in driving the D&C market these days. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »Cash Is King

It’s much easier to spend growth capital when each well drilled and completed is a smaller and smaller percentage of your cash on hand! So how’s that looking for the various oilfield participants? There’s a lot more to this story… Login to see the full update… To read this update …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve