We discuss how aggressively E&Ps will be as it pertains to developing their tight oil inventory in this piece… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Substitute For Organic Growth? Public E&Ps Ramped Up Their Capital Outlay Buying Private Shale E&Ps In 2022

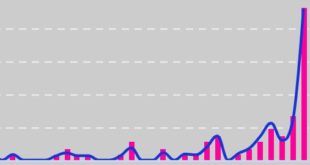

We discuss how aggressively Publics acquired Privates in shale E&P this year… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »Iran Strike And Saber Rattling Dramatically Underscore The Big US E&P Dilemma In 2020

Bang! 2020 is off to a dynamic start. Geopolitical risk has again taken the center stage, driving out-performance in crude oil prices and oilfield equities vs. the broader market in early-year trading. And this week’s developments on the global state punctuate a big question for the US oilfield this year, …

Read More »Thinning The Herd – The Public E&P Universe Is Shrinking Via M&A, Delistings

On the heels of yet another combination of public E&P operators this morning (PDC Energy and SRC Energy), we spent some time thinking about the expansion, peak and contraction of the public E&P universe. There’s a lot more to this story… Login to see the full update… To read this …

Read More »Permian Perspective Part One: Where We’ve Been, Thank Yous, & Full Throttle Local Sand Consumption

Our team’s week in the Permian Basin is flying by, and our notepad is filling up with boots-on-the-ground research takeaways. Here is our first round of observations from the world’s busiest oilfield… There’s a lot more to this story… Login to see the full update… To read this update and …

Read More »As Oil Prices Run, These 8 Operators Face A Big Test Of Their New Year’s Resolution

Ironically, all the recent talk of restraint by tight oil operators is a contributing factor to the recent crude oil price rally. In turn, rising oil prices will put to the test this newfound US operator resolve to reign in the willy nilly spending of prior upcycles. With WTI an …

Read More »Is It Really Different This Time? [Chart Of The Day]

We believe the recent surge of returns-focus rhetoric from E&Ps is having a considerable impact on consensus expectations for US shale E&P spending. This was evident in our recent survey, where participants expressed a bullish view on y/y oil price trends yet waxed conservative on the spending outlook. In this …

Read More »Tailwinds Form Behind 2018 E&P Capex Budgets

The following brief analytical editorial was excerpted from our twice-weekly newsletter on Tuesday October 31, 2017. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve