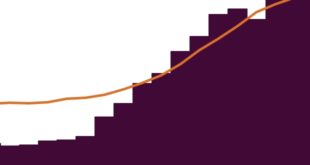

Earlier this week, we wrote that market expectations for U.S. oil production are too low (see report). In that piece, we pointed out that the EIA’s numbers only showed about 640kbpd of U.S. oil production growth in 2022. This compared to our 1mmpbd growth forecast. Subsequently, the EIA has revised …

Read More »Why Sand Pumped Matters More Than Any Thing Else In Shale

A data driven look at why proppant is the best indicator of oil production known to the shale industry… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Flat As A Pancake… [Chart Of The Day]

A wellness check this week on on the key economic engines of the oilfield industry reveals some interesting trends… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »There Is A Bright Spot In The Gloomy Lower 48 Oilpatch [Chart Of The Day + Macro Thesis Highlights]

“Give me some good news for a change,” you say? Our pleasure! Here is a chart you cannot miss because it’s all anyone’s going to be talking about as tight oil gets shut in. There’s a lot more to this story… Login to see the full update… To read this …

Read More »Iran Strike And Saber Rattling Dramatically Underscore The Big US E&P Dilemma In 2020

Bang! 2020 is off to a dynamic start. Geopolitical risk has again taken the center stage, driving out-performance in crude oil prices and oilfield equities vs. the broader market in early-year trading. And this week’s developments on the global state punctuate a big question for the US oilfield this year, …

Read More »Iran’s Ill-Advised Attack On Saudi Was Actually A Gift To The Kingdom [Friday Follow-Up Guest Post]

The Friday before last week’s drone attacks on Saudi oil infrastructure that caused oil prices to momentarily spike, Bill Edwards wrote a guest post for Infill Thinking titled Historical Oil Price Perspective & A Sober Long-Term Outlook [Friday Guest Post]. The way oil has traded in the wake of the …

Read More »A Shot In The Arm, But The US Frac Supply Chain Still Needs Surgery

Sunday was not a day of rest for most folks who think about the oil and gas industry for a living. We’ve never seen so many weekend news updates and research notes hit our inbox, and for good reason. In the days (and possibly weeks) ahead, you will see countless …

Read More »Historical Oil Price Perspective & A Sober Long-Term Outlook [Friday Guest Post]

Here at Infill Thinking, we are humble oilfield service guys by trade not well heeled oil price pundits. That said, we regularly talk to some of the best crude oil minds in the business. When they share noteworthy observations, we pass them along. One such oil price expert we check …

Read More »Some US Independents Are Chomping At The Bit To Raise 2018 Capex, Permian Pipe Aside [New Datapoints & Research Rewind]

After oil’s 2014 crash, the US shale “popularity pendulum” swung hard against animal spirits, moving in favor of capital discipline. Outspending in shale is now taboo on both Wall Street and Main Street. But is the recent societal shift emblematic of lasting structural change or is it simply cyclical banter? …

Read More »Will The Change In The NYMEX WTI Spec Shut In Canadian Crude? [New Post In Our Thinking Aloud Forum]

Just a heads up that a new thread has been started by William Edwards over in the Infill Thinking discussion forum. In the thread, William thinks about how a recent change in the Cushing WTI specs will impact Canadian prices and ultimately world crude oil prices. Spoiler alert – it’s not …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve