In light of today’s deal news, we wanted to share some of the recently formulated resources in our archive that we assembled to think through what this deal means for the frac and frac supply chain marketplace. We hope this research proves helpful as a new era begins at Liberty… …

Read More »Buyer Behavior Cliff Notes As Diamondback Consolidates The Northern Midland Basin

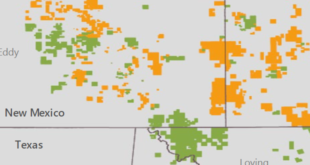

On the Monday before Christmas, Diamondback scooped up QEP and Guidon, consolidating a big chunk of Northern Midland Basin acreage. Here are some critical supply chain insights concerning these two operators that all vendors should be aware of… There’s a lot more to this story… Login to see the full …

Read More »In Other News… Merger Monday, Permian Weather, Nat Gas Bull Rush, Hydrogen Hype, & HAL “Dips A Toenail” In Renewables…

In addition to the in-depth updates published so far during this week in the frac life, these quick hits also crossed our desk and are worthy of a mention… There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »Buyer Behavior Cliff Notes As Devon & WPX Become One Frac Customer

The Devon / WPX deal continues the theme of Lower 48 E&P consolidation and creates the fourth largest unconventional oil producer in the US (only behind Oxy, Conoco and EOG). In the sections below, we provide some customer behavior context for the Devon / WPX merger – viewing the big …

Read More »A Penny On The Dollar For NWS Investments Gone Bad

A long-marketed Northern White Sand asset package finally found a buyer last week…. for what we estimate is a penny on the dollar relative to invested capital. This deal… There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »‘Project Stars’ Complete – Schlumberger’s Frac Team Hands Over The Keys To Liberty

As most readers know by now, Schlumberger sold their frac business to Liberty in a big deal announced this morning. The deal, code named “Project Stars” per the deck title, makes Liberty… There’s a lot more to this story… Login to see the full update… To read this update and …

Read More »Oilfield Water M&A Deal News Slows In Early-2020. Why & What’s Next…

2019 was a record year for M&A deals in oilfield water. Will 2020 be able to keep up the pace? There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »A New Year In Oilfield Water Management Brings More Of The Same… Sort Of.

2020 starts off much the same as 2019 ended in the oilfield water management industry: with M&A news. Two acquisitions were announced on Monday from undisclosed sellers (although we have heard some guesses about who one of those might be). Meanwhile, oilfield water M&A this year has a different feel …

Read More »Frac Equipment Fire Sales – Pumps For 10 Cents On The Dollar? Blenders For $2,500? Enter The Vulture Buyers…

It’d be better for the industry to see equipment scrapped than fire sold. When the market does turn, vulture investors will be able to bid very aggressively to get jobs with the equipment they are buying for pennies on the dollar today… There’s a lot more to this story… Login …

Read More »Thinning The Herd – The Public E&P Universe Is Shrinking Via M&A, Delistings

On the heels of yet another combination of public E&P operators this morning (PDC Energy and SRC Energy), we spent some time thinking about the expansion, peak and contraction of the public E&P universe. There’s a lot more to this story… Login to see the full update… To read this …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve