We discuss how aggressively Publics acquired Privates in shale E&P this year… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »Shale E&P Deal Count Is Spiking In 2022 [Charts Of The Day]

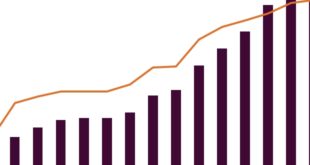

Investment bankers have been BUSY making deals happen in E&P during 2022. Here’s a data driven update on the situation… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »Got Cash? More Private Equity Backers Of Oilfield Firms Could Be Heading For The Exits

We think through some reasons why a lot of oilfield service companies could be up for sale – many more than normal at this point in the cycle – and what this could mean for M&A and consolidation going forward. There’s a lot more to this story… Login to see …

Read More »“Yeah But…” Industry Feedback On Our Thesis Of Frac Sand Consolidators Emerging

Following the logic on M&A possibly returning in frac sand… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please …

Read More »US E&P M&A Cools In 3Q After 2Q Bonanza. Deal Sprint Before Year-End Coming? [Charts Of The Day]

2Q21 was the busiest quarter for US E&P deal flow since we started keeping track of significant E&P M&A transactions in 2017. Here’s an update on what’s followed that in 3Q… There’s a lot more to this story… Login to see the full update… To read this update and receive …

Read More »US E&P Consolidation Surges Driving 2Q21 Deal Flow To New Heights [Charts Of The Day]

2Q21 is the busiest quarter for US E&P deal flow since we started keeping track of significant E&P M&A transactions in 2017. Not only are we already seeing new highs this quarter, but there are still three full weeks left in the quarter for bankers to add a few more …

Read More »How Will The Liberty Deal Reverberate In The Frac Sand Value Chain? [A Special 3-Part Report]

Now that we’ve all had a couple days to process the biggest frac industry news in quite a while, what does the M&A transaction mean for the proppant supply chain? Specifically frac sand and last mile logistics pure-play vendors? We have some strategic recommendations and actionalbe analysis on the competition …

Read More »Wild Wild West – Some Big News Brewing In A Key West Texas Ranch Sale Process [EXCLUSIVE]

Infill Thinking has confirmed that an LOI on a sales agreement has been signed on a West Texas ranch at the center of a bidding war, family controversy, and the oilfield water frenzy. There’s a lot more to this story… Login to see the full update… To read this update …

Read More »Four Likely Buyers In Oilfield Service For 2017

In E&P, most analysts expect M&A action to be hot and heavy during the first half of 2017. There is less consensus about a wave of M&A coming in oilfield service (OFS), partly because of challenging valuations. So we put pen to paper this week and came up with the …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve