With the rubber hitting the road on 2023 budget planning, OFS and E&P CEOs converged in New York this week for the annual Barclays energy investor conference. Here’s what stood out to us… There’s a lot more to this story… Login to see the full update… To read this update …

Read More »Well Costs Rising & Gap Filling… A Look At Why Shale E&P Capex Budgets Are Being Hiked

This earnings season, more than half the public E&Ps we monitor hiked their 2022 budget guidance. Many for the second time already this year… The publics are on track to spend 15-20% more than they originally communicated when 2022 budgets were set. Why? Well… There’s a lot more to this …

Read More »E&P D&C Fleet Tracker

We have rounded up a series of operator-by-operator fleet data…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please …

Read More »Macro Meltdown, But OFS May Be Best House In Bad Neighborhood! [Charts Of The Day]

Capital allocators have a tough job right now as the market focuses intently on discounting bigger risks into assets: inflation is terrible, more Fed rate hikes are coming, and recession fears loom large. Here are some reasons why we are still optimistic about oilfield investments. There’s a lot more to …

Read More »2022 Public E&P Capex Budget Patterns & Predictions [Chart Of The Day]

2022 budget analysis… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our current subscription …

Read More »Shale Well Cost Inflation Is Starting To Outpace Operator Expectations

What E&Ps are telling their investors is changing – the changes so far are subtle, but they are firm evidence that cost inflation has been underappreciated. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »Permian E&P Operators Begin 2022 With A Cheery Disposition

Several talking points in the E&P narrative this week stood out… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »Drilling Inefficiency Is Distorting Rig Count Impact On Frac Demand [Chart Of The Day]

If you are looking at the rig count going up every week and thinking that translates 1:1 to frac increases, think again… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »“Permianflation” & Fleet Tracking Part Two

Following up on two recent pieces of high value research with more datapotins further to the trends. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

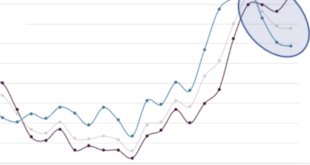

Read More »E&P Capex Guidance Provided Over Past Two Weeks Bodes Well For Frac Activity

Over the past week, we have processed capex spending updates from about 25 public shale E&Ps into our oilfield spending models. Data clients can access the latest operator-by-operator spending database here, which includes our 2022 expectations. Here’s a chart showing how things changed from our last update three months ago… …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve