Experienced E&P strategist Paul Sparks has been thinking about the future of what today is a highly fragmented E&P industry. As the US unconventional business matures, will it always be run by 50+ public Independents and hundreds of smaller privates? Or is mass consolidation the future? History and some of …

Read More »Is It Really Different This Time? [Chart Of The Day]

We believe the recent surge of returns-focus rhetoric from E&Ps is having a considerable impact on consensus expectations for US shale E&P spending. This was evident in our recent survey, where participants expressed a bullish view on y/y oil price trends yet waxed conservative on the spending outlook. In this …

Read More »Taking The Oilfield’s Temperature On 2018 [Call For Survey Responses]

We poll subscribers on key questions about the 2018 oilfield service outlook. Our Q&A will reveal consensus among some of the industry’s smartest minds about 2018 trends, themes, and debates. To participate and view the results, please login or subscribe. At Infill Thinking, we are very aware of what our …

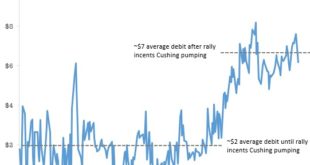

Read More »Are West Texas Producers Unnecessarily Taking A $5/Barrel Hickey?

There’s a new reader-submitted post in our thinking aloud forum, please visit the thread here to read and discuss how (and potentially why) the oil price rally is masking some important disconnects. Emerging discounts are impacting tight oil producers who sell product based of WTI benchmarks, but it may not …

Read More »Establishing A 2018 Tight Oil E&P Capex Growth Floor? The Most Budget Conscious E&P Set A 16% 2018 Increase Vs. Prior 2017 Plan

Anadarko’s 2018 capital spending program was released Thursday morning. It is one of the first detailed 2018 E&P budgets to be released this budget season. Given their focus on discipline and returns and leadership in crafting a sustainable framework for developing tight oil, Anadarko’s E&P capex budget should help establish …

Read More »Permian Frac Sand Scattershooting Part 2: Smart Sand’s Plan, Well Performance, New Contracts, Delaware Usage

Another installment in our popular series of tidbits on Permian Basin frac sand mine scene happenings. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »Reading The 2018 US E&P Capex Tea Leaves As Operators “Apologize” For Growing

This week, E&P management teams talked with investors about the big picture framework and mindset this budget season. We recap the key takeaways from the key players and review the overarching themes of 2018 budget season and what this means for oilfield service contractors. There’s a lot more to this …

Read More »A STACK / Delaware Leader Has Bought All Its 2018 Finer Mesh Sand From Southern Regional Mines

The unrivaled STACK E&P leader (and major Delaware player) said this Wednesday that they have contracted all of their 2018 frac sand requirements. This is newsworthy in and of itself, but more noteworthy is the geographical sourcing. We provide details and think through the market implications here. There’s a lot …

Read More »EOG Picked A Good One. Why Isn’t The Shale Industry Doing More Of This?

We provide experience-based insight on EOG’s latest corporate strategy move and break down how peers compare. We also discuss how this fits into current trends and why it makes sense in the new shale paradigm. There’s a lot more to this story… Login to see the full update… To read …

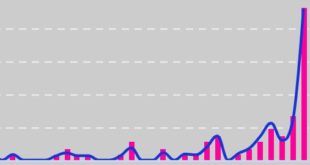

Read More »Diagnosis: US E&P 2017 Capex Is Stable & Within Normal Limits [Rebuttal Follow Up]

If 2H17 shale capex were on the operating table, our diagnosis would be that the patient’s vitals are stable and within normal limits. But as the old newspaper saying goes: “if it bleeds it leads,” so many reports continue to chose fear over reality. We dig into the numbers to …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve