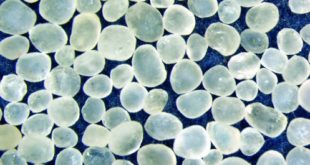

Retail giant Amazon and the hydraulic fracturing business have something in common: costly and complex last mile logistics. Distributing proppant requires just as much sophistication as distributing Echo Dots, Yeti Tumblers, and Kleenex. In 2017, more truckloads of sand per well will be pumped than ever before. The frac industry is trying …

Read More »Horsepower Feeding Frenzy In The Permian As ProPetro Launches The 2nd Frac IPO Of The Year

Following the well received initial public offering floated by Keane Group (ticker FRAC) in January, ProPetro filed for their IPO on Wednesday. They take the ticker PUMP – stale oilfield comp sheets are getting a trendy new makeover. This Permian pumper is going to grow fast – sign in to read all …

Read More »Let The Building Begin! NOV Books Its First Large Frac Pump Order Of The Recovery

There is optimism in NOV’s tone again. In this update, we share the very latest on their orders and outline what they are seeing from customers in terms of inquiries, needs, and technology demands as pockets of newbuilding return for the firs time in over two years… There’s a lot …

Read More »All Available US Frac Capacity May Be Consumed This Year

As we write, the US onshore rig count is breaching the 700 mark (it stood at 689 last week). In this update, we explore what happens when a rig count of 900 is reached (which could happen sooner than you might think). We dig into the details of how much …

Read More »Reports From Big Sand Are Still A Few Weeks Out, So Here Are Three Datapoints To Tide You Over

The big public frac sand suppliers (companies like Hi-Crush, US Silica, Fairmount Santrol, and Smart Sand) will be closely watched when they report earnings this quarter. Expectations for increased proppant demand are high as the US shale industry gets back to work. But Big Sand won’t be talking about their own …

Read More »FRAC IPOs Return… Literally. Meet The Next Public Completions Outfit

Frac IPOs are back. We mean that literally because the company about to make its public debut will trade under the ticker FRAC. This week, Keane Group Inc., owner of the 7th largest US frac fleet and employer of 1,251, filed an S-1 for a potential IPO. The company is …

Read More »A Deal Before Year-End: Patterson-UTI Pays Top Dollar For Seventy Seven Energy

Land drilling / pressure pumping hybrids Patterson-UTI and Seventy Seven Energy have agreed to join forces as 2016 draws to a close. Patterson-UTI will purchase Seventy Seven Energy for $1.76bn in an all-stock deal that includes the assumption and repayment of $336mm of net debt. This deal isn’t a bargain, as …

Read More »The New Weatherford CEO Won’t Frac For Free. So Will He Take One Million Horsepower Off The Market?

The new Weatherford CEO is reportedly in the process of undoing his predecessor’s hydraulic fracturing business plan. If what we’ve been told by industry contacts is true, Krishna Shivram (pictured left) is throttling back frac operations in dramatic fashion. This would be the second big move he’s made in three weeks at the …

Read More »There’s A New Anti-Frac Movement Brewing. It’s Leaders Are O&G Industry Insiders

Since inception, hydraulic fracturing and shale exploitation have been fraught with controversy. Initial opposition mostly came from the far left and environmentalists. So called “fracktivists” include bands of protesters, lobbyists pushing for regulation, and filmmakers documenting mythical terrors. These outsiders have presented challenges for the industry ranging from mild annoyances to outright banishment …

Read More »EOG And Continental Are Aggressively Completing Their DUCs Now

Leading Independent E&Ps like EOG Resources and Continental Resources are moving quickly now to complete their excess drilled but uncompleted (DUC) well inventories. The recent increase in oil prices into the $45 – $50 range was the signal to complete ’em if you got ’em. In this update we review the specifics …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve