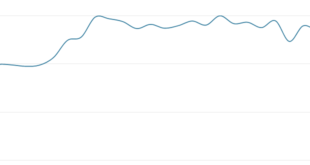

Over the past week, we’ve been sharing a series of data-driven reports on Permian frac sand volume trends. First, this chart of the day showed Permian proppant consumption returning to peak. The peak Permian sand piece prompted good questions about how sand can return to prior highs in an environment …

Read More »Frac Sand’s Separation From Traditional Drivers Introduces Forecasting Risks [Charts Of The Day]

Last week we shared a chart of the day showing Permian sand volumes returning to within 10% of the all-time best quarter in 2021 and breaking the record in 2022. That research prompted some rational thinking and questions, both from our members in the comments section and the EFT crew …

Read More »Where To Next For Frac Sand? Will The Industry Ever Be Able To Extract Itself From This Mess?

The frac sand business finds itself between a rock and hard place these days. The rock is extreme… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »A Deep Dive (& Some Fun) With The Historic Hearing On Texas Oil Cuts [Summary Of 9-Hour Testimony]

The Texas Railroad Commission (and a whole bunch of oilfield folks) had a very busy Tuesday. The three Commissioners hosted a nearly 9-hour long virtual open hearing on Tuesday, taking petitions for and against prorating Texas oil production. 20,000 viewers tuned in to watch the webcast. A whopping 53 industry …

Read More »It’s The Most Wonderful Time… For Tight Oil E&Ps With Change In Their Pocket & Long-Term Vision

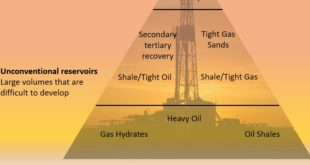

Looking at today’s depressed stock prices for tight oil operators and declining E&P activity trends, you’d never guess that this is actually a relatively wonderful time to be an E&P operator actively developing US tight oil resources. There’s a lot more to this story… Login to see the full update… …

Read More »The Future Of E&P Includes M&A And ESG [Friday Guest Post]

With Morgan Stanely also pushing an M&A narrative this week, Paul’s piece is timely. Paul’s been making the case for consolidation in E&P for about two years… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you …

Read More »Is It Really Different This Time? [Friday Guest Post]

Our latest guest post contains an important message regarding the current state and future of the E&P industry. We are bringing it to you in two pieces. This week, our guest contributor sets the stage on the current environment and tiers that have developed in the E&P industry. Next week, …

Read More »5 Things To Think About For The 2019 US Oilfield Service Outlook [Macro Musings]

WTI at $42 on Christmas Eve was something that that almost no one expected on Halloween. The chief debate that oilfield suppliers are grappling with in early-January is how macro volatility will impact 2019 E&P capex spending, and as such, jolt the addressable US onshore market. We provide analysis in …

Read More »Planned Local Sand Supply Has Surpassed Estimated 2019 Demand In Four Big Basins [Chart Of The Day]

Is the frac sand greenfield rush of 2017/2018 finally over? It’s a question worth asking since each of the Big 4 markets are now flush with planned local sand supply. In the chart below, we compare our total 2019 frac sand demand estimates for four major markets to announced local frac …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve