This week, we spent some time interacting with executives and senior finance folks from outside our core O&G rolodex… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Energy Transitioning The Oilfield Out Of A Job?… Not So Fast My Friend…

Importantly as we listened to the oilfield’s commentary around energy transition this quarter, we were struck by the fact that oilfield management teams are optimistic not pessimistic about this. Remember SWOT analysis from business school? The oilfield is looking at energy transition as an “O” not a “T.” There’s a …

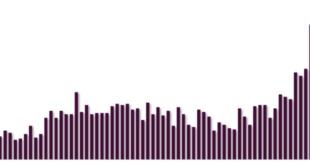

Read More »Oilfield Equity Bottle Rockets [Chart Of The Day]

It’s still a month until July Fourth, but there are already some bottle rockets being lit in the oilfield. Here’s what the stock market says about the state of things in the oilfield… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »Why Is ESG Trending In O&G? Follow The Money, But Remember HSE & Societal Value Predate The Trend In O&G

In this update, three charts – one showing the surge of ESG interest in the oilfield and two others explaining why. The data is followed up with in-depth analysis and commentary on sentiment, investment, why it matters, who’s doing what, RFQ impacts, what oilfield niches have big ESG opportunities, and …

Read More »It’s Early, But Here Are The Most Important Things Oilfield Service Customers Have Said About 2019

Equally as important as the 2019 spending program figures being released this season is the accompanying management commentary. In fact, this is actually more important than the headline numbers in some cases. We discuss what has caught our eye so far in the 2019 planning season and also provide readers …

Read More »You Will Be Judged On Survivability And Time: Assessing The Perilous Energy Investment Landscape

I can’t think of another time in my career that such a substantial upward move in oil prices was accompanied by so little investor enthusiasm for E&P and OFS stocks. At times over the last 18 months, it’s felt as if the group has collectively traded like a dying industry. …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve