Last week, we joined 175 senior oilfield water industry professionals at the 3rd Annual Oilfield Water Industry Update conference at the Houstonian. It was a full house and a full discussion – there is no shortage of excitement in the sector at present. Here are some key takeaways from the …

Read More »Are Frac Sand’s Strategic Consolidators FINALLY Emerging?

Several recent datapoints may start to answer a key question holding up frac sand consolidation: who will the buyers be? Everyone in frac sand expects M&A…eventually… But the biggest hold-up to a deal flurry in the past 12-24 months has been a… There’s a lot more to this story… Login …

Read More »US E&P M&A Cools In 3Q After 2Q Bonanza. Deal Sprint Before Year-End Coming? [Charts Of The Day]

2Q21 was the busiest quarter for US E&P deal flow since we started keeping track of significant E&P M&A transactions in 2017. Here’s an update on what’s followed that in 3Q… There’s a lot more to this story… Login to see the full update… To read this update and receive …

Read More »Project Bowie Complete – NexTier Takes Over The Alamo!

As most readers probably know by now, Alamo Pressure Pumping has sold out to Nextier in a big frac’ing deal announced late Wednesday afternoon. A public pumper takes out a large private pumper, adding to their foothold in the Permian while advancing the frac HHP consolidation narrative. This is good …

Read More »US E&P Consolidation Surges Driving 2Q21 Deal Flow To New Heights [Charts Of The Day]

2Q21 is the busiest quarter for US E&P deal flow since we started keeping track of significant E&P M&A transactions in 2017. Not only are we already seeing new highs this quarter, but there are still three full weeks left in the quarter for bankers to add a few more …

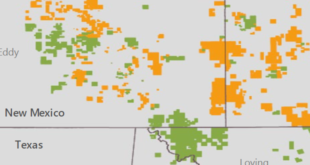

Read More »Buyer Behavior Cliff Notes As Diamondback Consolidates The Northern Midland Basin

On the Monday before Christmas, Diamondback scooped up QEP and Guidon, consolidating a big chunk of Northern Midland Basin acreage. Here are some critical supply chain insights concerning these two operators that all vendors should be aware of… There’s a lot more to this story… Login to see the full …

Read More »E&P Consolidation Trend Kicking Into High Gear? Big Operator Rollups Left & Right Since July….

Yes folks, it’s true… what you’ve heard…. the oilfield marketplace is a changing and the competitive landscape we’ve all gotten used to for the past decade or so could look very very VERY different a decade from now… There’s a lot more to this story… Login to see the full …

Read More »Buyer Behavior Cliff Notes As Devon & WPX Become One Frac Customer

The Devon / WPX deal continues the theme of Lower 48 E&P consolidation and creates the fourth largest unconventional oil producer in the US (only behind Oxy, Conoco and EOG). In the sections below, we provide some customer behavior context for the Devon / WPX merger – viewing the big …

Read More »A Penny On The Dollar For NWS Investments Gone Bad

A long-marketed Northern White Sand asset package finally found a buyer last week…. for what we estimate is a penny on the dollar relative to invested capital. This deal… There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »How Will The Liberty Deal Reverberate In The Frac Sand Value Chain? [A Special 3-Part Report]

Now that we’ve all had a couple days to process the biggest frac industry news in quite a while, what does the M&A transaction mean for the proppant supply chain? Specifically frac sand and last mile logistics pure-play vendors? We have some strategic recommendations and actionalbe analysis on the competition …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve