On Tuesday, we warned that by taking their foot of the capex gas pedal at this point in the cycle, the Independents risk ceding share in shale development to the Majors. On Wednesday, Chevron’s 2018 budget release confirmed that this indeed will happen if actions follow words. There’s a lot …

Read More »In The Nation’s Two Biggest Liquids Plays, It’s A Tale Of Two Cities

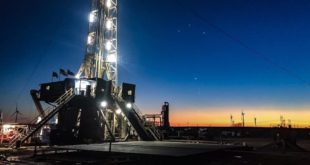

In this weekly rig count update, we take a quick look at the rig count evolution of today’s two most important US onshore markets: West Texas and Oklahoma. You may remember the following chart from an update early this year when we wrote about the bifurcated Permian market place…. …

Read More »Monday Night Football Was A Snooze… Hi-Crush’s Analyst Night Packed A Bigger Punch

While the Lions were busy pummeling the Giants 24-10 on Monday night, Hi-Crush was hosting an analyst day (or night as it were) for investors. Over dinner at the Holiday Inn in Odessa Texas, the event showcased nine senior executives providing an in-depth overview of the company’s business and introducing …

Read More »Download The Latest West Texas Mine Project List Here [Excel File]

We updated our table of planned frac sand mining facilities in the Permian after several readers asked for the latest file this week. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »The US Rig Count Just Hit Halliburton’s “Equilibrium Point”

Last week, the US land rig count breached 900 (stands at 902). We are now at the level Halliburton famously pronounced “the new equilibrium” one year ago. We address what this means for completions, frac horsepower, and US oil production in this update. There’s a lot more to this story… Login to see the …

Read More »Rig Count Charts For Three Recent Infill Thinking Observations: Haynesville, Delaware, & Sand Gap

This update started with three qualitative observations we wrote about over the past several days. These sent us back into the spreadsheets for today’s piece. We sliced and diced drilling data to expound on Haynesville green shoots, a Delaware Basin push, and frac sand valuation commentaries. There’s a lot more …

Read More »The Last Time Permian Operators Got Permits Like This, They Had 25% More Rigs On The Payroll

Drilling permit data from March showed increased operator appetite for drilling and more room to run for the rig count. We share a chart capturing the trend and break down the permit data into actionable analysis on hot spots and top operators. There’s a lot more to this story… Login …

Read More »Another Day, Another Permian Deal

WPX Energy joined in the Permian deal making fray, announcing a $775mm Delaware Basin acquisition late Thursday. 2017 operating plan announcements from Permian Independents aren’t the standard fare this year. We are used beginning of year E&P operating plans stating capex, production, and drilling program summaries. This year they are …

Read More »The Tenaris Midland Service Center Is Not Just Another Pipe Yard

We visited the sprawling $36mm Tenaris Midland Service Center this week. From this new Permian Basin facility, Tenaris is introducing Rig Direct™ to the US shale plays. Here Tenaris is running OCTG (casing and tubing), sucker rods, coiled tubing, and accessories in 24/7 operations. The Midland Service Center is the …

Read More »Permianflation – Acreage Arms Race Precedes Price Increases Coming Across The Value Chain

Permian acreage values are changing rapidly, frustrating those who want in and providing a windfall to incumbent operators. What some are calling an acreage valuation bubble in the Permian may be just the tip of an inflation iceberg in the play. A tsunami of capital targeting deals in the region …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve