Rig count remains under pressure, slipping AGAIN this week, down five and now threatening to move down into the 220s next week. Here are two… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »Drilling Market Share Changes From Top To Covid Bottom

This week we take stock of market share evolution in the US onshore drilling business during these crazy Covid times… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »In March, Two Land Drillers Had More Active Rigs Than The Entire US Does Today & They Agree There Is Still Downside

In this week’s rig count update, we shine a spotlight on a squishy bottom and lack of visibility in the US land rig market where two contractors took a different tone to discussing the bottom than one of their peers’ bolder statement several days earlier… There’s a lot more to …

Read More »Nowhere To Go But Up? Taking The Oilfield’s Pulse As The Dust Settles On An Epic Downturn

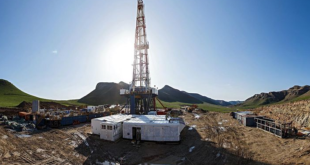

By putting our heads together as a group, Infill Thinking members will establish an important baseline this summer for understanding the “what now” and “what next” in the new paradigm emerging for the oilfield marketplace after the worst crisis in shale’s history. There’s a lot more to this story… Login …

Read More »On The Oilfield’s Second Black Monday This Spring… One Word Comes To Mind: TEMPORARY

We know you know the logic, but on days like today, it’s good to read and re-read the crude oil cyclical rationale in it’s simplest form, which is as follows: There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More »The Customer Is Always Right, And Here Are The Most Notable Things Frac Sand Customers Said In February

EOG said recently that better pairing of origin and destination vs. 2019 will help them achieve targeted well cost savings. We wonder if this is simply better availability of local sand near their wells or possibly mobile mini plant adoption? Here is the key quote as well as other interesting …

Read More »It’s The Most Wonderful Time… For Tight Oil E&Ps With Change In Their Pocket & Long-Term Vision

Looking at today’s depressed stock prices for tight oil operators and declining E&P activity trends, you’d never guess that this is actually a relatively wonderful time to be an E&P operator actively developing US tight oil resources. There’s a lot more to this story… Login to see the full update… …

Read More »In Other News… Appalachia Hibernation, Buy Orange Pumps!, Frac Shutdown, Death By 1,000 Cuts For Irrational Projections?, Mine Hit Piece, & More…

In addition to the in-depth updates published over the past week, these 11 “quick hit” datapoints also crossed our desk and are worthy of a mention… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »Ranking E&P RIF Risk With A New Staff Efficiency Benchmark [Chart Of The Day]

For years – even before capital discipline started trending in 2017 – Wall Street research analysts have constructed models to benchmark the effectiveness of E&P capital deployment. But what if we turn the logic around a bit and look for layoff risk indicators in the size of… There’s a lot …

Read More »Last Call For Summer Survey…Polls Close This Evening

At Infill Thinking, we are very aware of what our greatest asset is. Without a doubt it is our membership roster. We are honored to have on this list some of the most accomplished executives in the US onshore business. We are also very aware of what the key debates …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve