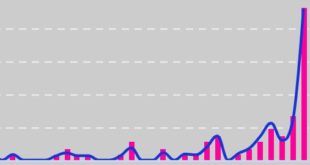

Historical and projected spending trends in natural gas basins… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email …

Read More »What’s Left In The Tank For The Rest Of The Year For Oily E&Ps? Quite A Bit Actually… [Chart Of The Day]

Want to know what to expect for the rest of the year in the US onshore oilfield? This data-driven update is a must read… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »Still Some Work To Do, But Big 2Q20 Cuts Helped US E&Ps Get Back On Budget Track [Chart Of The Day]

Want to know what to expect for the rest of the year in the US onshore oilfield? This update is a must read… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »The Most Important Thing To Watch This E&P Earnings Season If You Are An OFS Provider [Chart Of The Day]

With E&P earnings heating over the next 7-10 business days, one critical thing we’ll be watching closely is how…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Frac ‘Til May Then Go Away? E&P Budget Exhaustion Comes Early This Year

The chart below visualizes US E&P operator budgets in a very important way… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership …

Read More »It’s Official: Known 2019 US E&P Spending Programs Enter Contraction Territory

2019 E&P capex budget expectations have devolved fairly rapidly, worn down by macro erosion and crude oil price volatility. Over the past several months, multiple Infill Thinking updates have warned that 2019 E&P budgets (which initially pointed to spending increases) were at risk of contracting into negative territory in the …

Read More »2019 US Onshore E&P Budgets Starting To Fade In Aggregate [Updated Table]

Some of the most important numbers of early-2019 are trickling out and we’re tracking them here so you don’t have to. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you …

Read More »It’s Early, But Here Are The Most Important Things Oilfield Service Customers Have Said About 2019

Equally as important as the 2019 spending program figures being released this season is the accompanying management commentary. In fact, this is actually more important than the headline numbers in some cases. We discuss what has caught our eye so far in the 2019 planning season and also provide readers …

Read More »The Independents May Intend To Temper Tight Oil Growth Next Year, But The Majors Sure Don’t…

On Tuesday, we warned that by taking their foot of the capex gas pedal at this point in the cycle, the Independents risk ceding share in shale development to the Majors. On Wednesday, Chevron’s 2018 budget release confirmed that this indeed will happen if actions follow words. There’s a lot …

Read More »Is It Really Different This Time? [Chart Of The Day]

We believe the recent surge of returns-focus rhetoric from E&Ps is having a considerable impact on consensus expectations for US shale E&P spending. This was evident in our recent survey, where participants expressed a bullish view on y/y oil price trends yet waxed conservative on the spending outlook. In this …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve