Supply chain inflation is a trending topic in O&G. One of the biggest debates in the oilfield today centers around the sustainability of the cost reductions E&Ps achieved during the downturn. How much was lasting process change and innovation vs. temporary supply chain price concessions? E&Ps will be far more …

Read More »It’s Becoming A Rig Seller’s Market When Contractors Showcase Spot Exposure Instead Of Backlog

Just a few months ago, US land rig management teams were still touting their long-term contracts as an asset. Highlighting backlog and term duration is a defensive posture contractors assume when operators have pricing power. Rig count can rise. Dayrates can trough. But until management teams start talking about spot …

Read More »US Land Rig Count Update For February 24, 2017

The US onshore rig count increased 3 rigs to 733 running last week. The US land rig count is now up 359 rigs from the May 2016 bottom. Much of these gains have come from the Permian, where growth is being driven by horizontal drilling in both the Midland Basin and the Delaware …

Read More »It Might Not Feel Like It, But Operators Are Still Winning As Land Rig Dayrates Rise

ConocoPhillips is baffled by recent dayrate hikes by the US land drillers. And they aren’t the only operators that feel this way we take a look at what ConocoPhillips’ CEO had to say about it and explore why the operators shouldn’t feel too bad about a few grand a day …

Read More »As The Offshore Drillers Wait For 2020, Some Will Pay To Work

Diamond Offshore was the first offshore driller to host its 4Q16 earnings conference call on Monday morning. In this post, we extract the most poignant statements management made on the call about the future of the offshore drilling business, identifying and corroborating some of the most important themes in the offshore …

Read More »Time To Clear The Yards

The US onshore rig count increased another 19 rigs to 689 running last week. All of this activity coming back means rigs are being moved out of the yards and into the field. This creates a veritable boom for rig movers. We uncovered some proprietary market intelligence on rig moves …

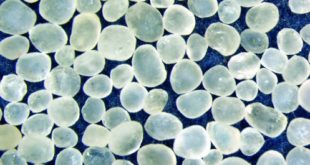

Read More »Reports From Big Sand Are Still A Few Weeks Out, So Here Are Three Datapoints To Tide You Over

The big public frac sand suppliers (companies like Hi-Crush, US Silica, Fairmount Santrol, and Smart Sand) will be closely watched when they report earnings this quarter. Expectations for increased proppant demand are high as the US shale industry gets back to work. But Big Sand won’t be talking about their own …

Read More »It’s A Good But Tricky Place In The Cycle For Oilfield Service Pricing

Oilfield service pricing moving higher cyclically is a good thing for all our readers (including operators, for current pricing is unsustainable and will destroy capacity in the long run). That said, we stand at a tricky juncture in the cycle for oilfield service company decision makers trying to reset their …

Read More »As 2017 E&P Budgets Kick In, Permian Rig Count Sizzles

After a brush back in the second week of the year, the US land rig count surged ahead last week. 2017 E&P budgets and drilling programs are kicking in and we expect continued strength over the next 4-6 weeks. Take out a free trial below to see our full analysis of …

Read More »8 Quick Trends To Listen For During Oilfield Service Conference Calls This Earnings Season

Schlumberger kicks off 4Q earnings season this week, hosting a conference call Friday morning to discuss the 2017 outlook. During the fourth quarter, a cyclical inflection point materialized in the US onshore market. A key question during the calls this earnings season will be how sustainable the cyclical growth trajectory …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve