A powerful narrative shift is underway with big implications for U.S. oil and gas production, producers, and enablers… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »As WTI Trades Above $110/BBL (14-Year High!), A Salute To Shale & What Our Readers Do To Further Its Noble Cause…

The world is a mess. The tyranny of an evil man is on full display, disrupting world order, and it won’t be soon forgotten as an uncertain globe witnesses unprovoked civilian devastation from the biggest military action in Europe since WWII. The ripple effects could obviously be profound. As a …

Read More »There Is A Bright Spot In The Gloomy Lower 48 Oilpatch [Chart Of The Day + Macro Thesis Highlights]

“Give me some good news for a change,” you say? Our pleasure! Here is a chart you cannot miss because it’s all anyone’s going to be talking about as tight oil gets shut in. There’s a lot more to this story… Login to see the full update… To read this …

Read More »As Bad As Paper Oil Prices Got On Monday, The Real Spot Bid Got Worse [Chart Of The Day]

You’ve gotta see this chart to believe it. Consider our minds blown. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »Paper Trades Make Oil Prices Look Better Than They Are In The Physical Market… [Chart Of The Day]

Torn by two extreme market forces (oil demand destruction from the lockdown and geopolitical supplier actions), US oil prices are being distorted and dislocated beyond recognition. Here’s how the actual spot bids in the field are trending across various grades and basins (spoiler alert, it isn’t pretty and the lowest …

Read More »Iran Strike And Saber Rattling Dramatically Underscore The Big US E&P Dilemma In 2020

Bang! 2020 is off to a dynamic start. Geopolitical risk has again taken the center stage, driving out-performance in crude oil prices and oilfield equities vs. the broader market in early-year trading. And this week’s developments on the global state punctuate a big question for the US oilfield this year, …

Read More »Will The Change In The NYMEX WTI Spec Shut In Canadian Crude? [New Post In Our Thinking Aloud Forum]

Just a heads up that a new thread has been started by William Edwards over in the Infill Thinking discussion forum. In the thread, William thinks about how a recent change in the Cushing WTI specs will impact Canadian prices and ultimately world crude oil prices. Spoiler alert – it’s not …

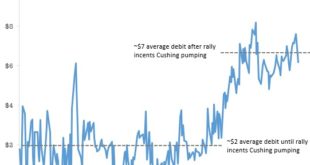

Read More »Are West Texas Producers Unnecessarily Taking A $5/Barrel Hickey?

There’s a new reader-submitted post in our thinking aloud forum, please visit the thread here to read and discuss how (and potentially why) the oil price rally is masking some important disconnects. Emerging discounts are impacting tight oil producers who sell product based of WTI benchmarks, but it may not …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve